Saxo Bank Q1 2025 Quarterly Outlook: Trump 2.0 – Can the US have its cake and eat it, too?

President-elect Donald J. Trump will hit the ground running after his January 20 inauguration as he has promised a blitz of new

initiatives and policy announcements from day one. Global markets will spend the first quarter of 2025 in reaction mode, even

well before the impacts and knock-on effects of the Trump agenda are known. And many of the key Trump 2.0 initiatives, from

taxation and deregulation to fiscal policy, will likely not fully crystallize until fiscal year 2026.

But markets will do their level best to look ahead and are likely to trade with considerable volatility as the world finds its sea legs

with a more forceful US policy mix that stimulates a varied response domestically and especially in the wider world.

The US: to what degree can Trump force the US agenda on the rest of the world?

Markets initially reacted to the strong Trump victory and Republican sweep of Congress as an unalloyed positive for markets

in similar fashion to the 2016 election outcome, as the US dollar rallied, US yields shot higher and US equities rallied broadly.

But by year-end, while US yields and the big dollar remained firm, the broad stock market reaction, as measured by the equalweight S&P 500 Index, traded about 2% below Election Day levels. This is perhaps as the Trump 2.0 agenda is fraught with

so many policy contradictions and uncertainties that markets are wary of jumping to conclusions. It was also due to the Fed’s

hawkish guidance at the December 18 FOMC meeting, as it didn’t want to pre-commit to much further easing based on the same

uncertainties in the outlook the market is grappling with.

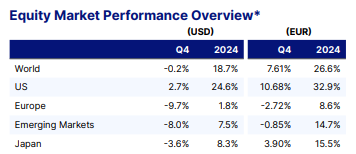

Table: 2024 was a remarkable year for global equities, which mostly means US equities, as the latter make up as much as 70% of

the MSCI World index. This is an incredibly concentrated index now with so much of its exposure to the US mega-caps: the top

20 US stocks by market cap are now some 40% of this index. Elsewhere, the strong US dollar limited emerging market gains in

2024, but Europe was the real laggard despite a respectable performance in EUR terms for the year for the MSCI Europe index.

The Trump plan: sounds too easy?

The Trump agenda is to reindustrialize the US to both bring back manufacturing jobs and improve national security, which the

pandemic made clear includes critical industrial supply chains. At the same time, the aim is to improve the country’s massive

trade and budget deficits and overall spiraling debt trajectory while keeping inflation low – all without any market pain, of course.

These goals are inherently contradictory outside of some miraculous productivity- and real growth miracle. Trump hopes that

most of the above agenda is achievable and paid for by tariffs and economic growth.

US Treasury Secretary nominee Scott Bessent has touted a “3-3-3 plan” to deliver the Trump agenda: to include a chop to the

fiscal deficit of 3% of GDP (from more than twice that in recent years), real GDP growth of 3% delivered via deregulation and tax

cuts, and low inflation via an additional 3 million barrels a day “equivalent” growth in US oil/gas production. Good luck! More likely,

we’ll see half that amount of growth or less because any fiscal slowdown by definition will subtract from overall GDP growth.

After all, it was the Biden deficits that drove much of the US growth out-performance relative to the rest of the world in the last

two years, preventing that pandemic-hangover US recession that just never seemed to arrive.

Besides the risk from fiscal drag, the size of which will be highly dependent on the ability of the Musk/Ramaswamy “DOGE” to

make its mark, other drivers of a 2025 growth slowdown could be dislocations from tariff uncertainty. A final wildcard is the

status of the AI investment boom. Consensus US GDP growth forecasts for 2025 are at +2.1%, a rosy forecast given the risks.

US treasury market: the reality check?

US Treasury yields rose all along the yield curve ahead of Trump’s inauguration as the market makes the general assessment that

the new president will bring some combination of sticky inflation and still very large budget deficits, and even solid economic

growth as well. But can the US treasury market hold up without intervention, given the blitz of issuance in the year ahead and

the vertiginous rise in the US debt servicing bill – much of it going to foreigners who aren’t even taxed on their income on US

public debt? Current forecasts put the 2025 US treasury debt service bill at a net USD 1 trillion, up from less than USD 900 billion

in 2024 and USD 650 billion in 2023. The only scenario that can cap longer US treasury yields via organic market forces might

be an ugly recession amidst massive DOGE fiscal spending cuts and a flight out of risky assets. Even so, such a recession would

eventually worsen the deficit/debt trajectory and inevitably spark a fresh combination of new Fed QE and politically obligatory

fiscal stimulus to come hot on its heels. Either way, all paths require that over the medium to longer term, nominal US GDP rises

faster than the average interest rate at which the US treasury issues debt.

Additionally, there are ways that some of Trump’s team are discussing dealing with both the long term stability of the US treasury

market and while maintaining the use of the US dollar as the preferred global reserve and transaction currency. This is covered

in our quarterly outlook for currencies.

And then there is the rest of the world.

Let’s remember as we look ahead that the US is not the only actor on the global stage and we can expect a response from all

global players large and small to the US agenda on top of ongoing pressing matters at home.

China in a G2 or G-Zero world?

For the US-China relationship under Presidents Trump and Xi, the potential outcomes are incredibly diverse, from Trump’s “G2”

idea that the US and China can sit down and solve the world’s problems to Eurasia Group Ian Bremmer’s “G-Zero” world, in which

we have chaos, because no one is fully in charge any more in a multi-polar world.

We suspect Trump will open with targeted tariffs with the promise of more to come but with an invitation for deal-making. At the

same time, with or without some grand bargain on US-China trade- and currency policies, perhaps even a full “Mar-a-lago accord”,

China needs to reflate its economy. All of this and much more on China covered in Charu’s piece on the outlook for China.

Europe – the view from the bottom

Europe has one distinct advantage relative to most of the rest of the world: things are already so bad for core Europe that they

may have a hard time getting any worse, at least for the traditional two key large core Eurozone powers, France and Germany.

France is the Eurozone’s softest spot and at best, the outlook is for a “muddling through” due to intractable political problems

and ugly debt dynamics. The French fiscal stability concerns are sufficiently stark that in the first trading days of 2025, French

10-year yields rose above Greek 10-year yields for the first time ever.

Germany, meanwhile, offers considerable upside potential after the coming February 23 election, with the chief question only

the degree to which it will realize that potential. Likely new Chancellor, the CDU leader Friedrich Merz, has made all of the right

noises on lowering taxes and non-wage cost overhead for corporations, as well as discussing exceptions to the country’s “debtbrake” rules that have traditionally prevented large-scale fiscal stimulus outside of dire emergencies like the pandemic.

Germany has under-invested domestically in digital and other infrastructure and its mostly heavy-industry industrial export

model is challenged by high energy input prices after Russia’s cheap natural gas is no longer available, increasingly stiff direct

competition from China and the prospect for steep Trump tariffs to boot. Productivity growth (especially via lower energy prices),

deregulation and increased investment in infrastructure and opening up for innovation are the call-phrases here, not doubling

down to keep the creaking old industrial model turning over, as outgoing Chancellor Scholz would have Germany do.

Still, a German comeback risks under-whelming in its early phases as Merz will have to find an awkward coalition partner postelection given that the likely second-largest party in the election, the AfD, are still considered untouchable politically for the

mainstream parties. A lash-up with the SPD or Greens would likely see half-measures and modest brightening of the outlook

rather than sweeping new policies that trigger a boom.

The one big wild-card for Europe is the potential for euro-bond issuance at the Eurozone level to fund massive new national

security investments, at first chiefly military, but possibly also to secure long-term cheaper energy supplies and better transEuropean infrastructure and supply chains. Eurozone leaders would do well to consult Mario Draghi’s The Future of European

Competitiveness (https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en), which

outlines much of the European playbook needed.

Last Updated on 1 week by News Desk 1