7 out of 10 people in UAE feel money confident, survey reveals

A record 75% of residents are expecting a bonus in 2025, according to a new survey by YouGov commissioned by Zurich International Life Limited in the UAE. This jump from 68% in 2024 reflects not only increasing optimism but also a shift in financial behaviour—one that suggests a growing focus on strategic planning leading to long-term financial security.

With 68% of residents planning to save at least a portion of their bonus, it’s clear that long-term financial planning is taking hold across the nation. This increase in expectations signals a broader optimism in the UAE economy, where residents are feeling more secure and ready to invest in their future.

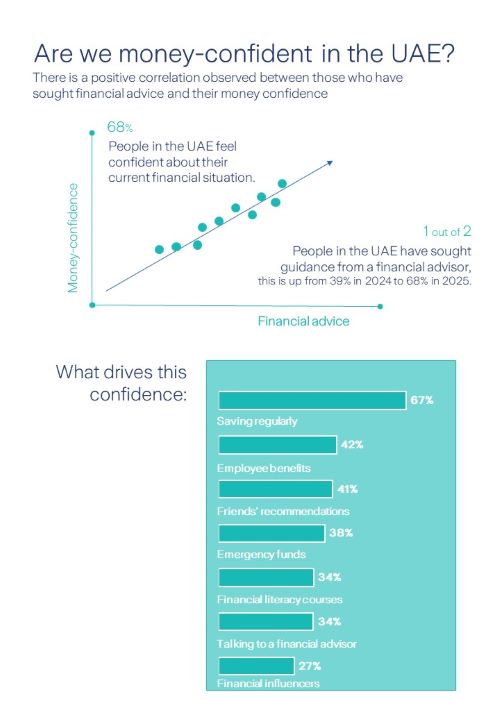

The survey also reveals that 68% of UAE residents feel confident about their current money situation. More importantly, those who have sought professional financial advice report significantly higher levels of confidence, with 79% of them feeling more future-confident.

According to the survey, there is also a rise in financial advisory consultations, up from 39% in 2024 to 55% in 2025, of residents and citizens speaking to financial advisors, indicating a growing awareness of the value of advice. As residents increasingly recognise the need for expert guidance in an evolving economic landscape, financial advisors continue to become key players in building a more financially literate society.

There is growing confidence, with 75% of people feeling optimistic about having enough money to fund their retirement. This reflects a stronger commitment to long-term financial security. This optimism is driving more proactive financial decisions, with residents prioritizing savings, investments, and retirement planning to build a stable financial future.

The balancing act of Saving vs Spending

The dual approach of saving and spending is becoming increasingly common among UAE residents. With a significant portion planning to save at least part of their bonus, these allocations reflect a thoughtful balance. Among savers, 55% are focused on future investments, 46% are building emergency funds, and 38% are putting aside money for their children’s education.

On the other side, 60% of those choosing to spend their bonus will allocate it to travel or holidays, and interestingly a breakthrough trend observed is 27% plan to invest in skill-building. This highlights that while financial security remains a priority, there is also recognition of the need to enjoy life’s experiences and personal development, creating a balanced financial mindset across the country.

Generational shifts in financial planning

When examining generational attitudes, younger residents show a clear commitment to saving for the future. A notable 31% of Gen Z (18-24) plan to save their entire bonus, showcasing a strong commitment to financial security from an early age. In contrast, 52% of those aged 45 and above intend to save most of their bonus rather than all of it, indicating a more flexible approach to financial planning that balances saving with other priorities.

Millennials (25-34) also stand out, with 63% opting to save all or most of their bonus. This intergenerational shift suggests a broader trend toward financial responsibility, with younger generations leading the way in planning for long-term financial stability while still balancing immediate financial needs.

“As financial awareness continues to grow across all generations, it’s clear that UAE residents are becoming more proactive in managing their money. Younger age groups, in particular, are leading the way, signalling a shift toward long-term planning and financial stability being ingrained in culture. The ability to balance saving with spending highlights a mature approach to financial well-being, where residents are not only preparing for the future but also prioritising personal growth and experiences,” said David Denton-Cardew, Head of Propositions at Zurich International Life Middle East.

The UAE’s growing focus on retirement savings

75% of respondents feel confident about having enough funds to retire. However, 61% believe that AED 5 million or less is sufficient, highlighting a critical gap in retirement planning. Interestingly, 65% rely on workplace savings or gratuity, potentially overestimating their long-term value.

While gratuity may provide a financial cushion, it is not a sustainable retirement plan on its own. To build long-term financial security, residents should consider structured savings options and make proactive investment decisions, such as allocating a portion of bonuses and salary increments. While optimism around financial preparedness is strong, the survey underscores the need for greater awareness of the actual savings required for a comfortable retirement.

A confident financial outlook for the UAE

The data suggests a positive correlation between money confidence amongst those who have sought financial advice and a significant shift in how residents view their financial futures. With more individuals talking to financial advisors, planning for their retirement, and balancing their spending with saving, it’s clear that UAE residents are embracing a more proactive and thoughtful approach to their finances. This trend reflects a brighter financial future for the UAE, where long-term planning and financial security are becoming key priorities for residents across all generations.

For more details on the research and its findings, find the full report here

Last Updated on 6 hours by News Desk 1