Eid al-Fitr and Ramadan Drive MENA E-Commerce Boom: 150% Increase in Gift Demand, with 30% Growth Expected for Eid 2025

Flowwow, a UAE-based gifting marketplace, partnered with Admitad to conduct research ahead of Eid al-Fitr, highlighting significant growth in online shopping and gifting. The study, which analysed over 900,000 customer orders, revealed a 150%+ surge in gift demand during Ramadan 2025, with a forecasted 10% increase in online sales and a 30% rise in GMV for Eid al-Fitr.

Shoppers in MENA are increasingly turning to online gifting during this time of generosity and family connection. As the MENA gifting market is projected to grow from USD 6.36 billion in 2025 to USD 8.47 billion by 2032, exhibiting a CAGR of 4.16%, both e-commerce giants, super apps, and niche gifting platforms are expanding their gift categories to capture a larger share of the growing demand for online gifting during the Ramadan month.

Eid al-Fitr 2025 Expected to Set New Sales Records

The latest numbers confirm that this year’s Ramadan sales in MENA have outpaced 2024, with a 9% increase in total sales and an impressive 35% growth in Gross Merchandise Value (GMV). Saudi Arabia saw an even bigger e-commerce peak, with sales increased by 30% and GMV rising 35%. The UAE also experienced a 20% boost in orders, with GMV growing 13% in 2025.

With strong early Ramadan sales this year, Flowwow and Admitad experts predict a record-breaking Eid al-Fitr 2025, forecasting a 10% rise in online sales and a 30% increase in GMV compared to last year.

“The Ramadan and Eid season continues to be a peak period for e-commerce in the MENA region, driven by the growing consumer preference for online shopping and gifting. This trend is particularly pronounced in Saudi Arabia and the UAE, where digital retail adoption remains strong,” said Anna Gidirim, CEO at Admitad.

E-Commerce Growth and Higher Spending During Ramadan and Eid al-Fitr

While Ramadan has always been a key shopping season, 2024 saw an even greater shift to online spending. During Eid al-Fitr, sales across MENA skyrocketed by 38%, with total spending up by 36% compared to the previous year. Saudi Arabia saw an impressive 50% rise in orders, with Gross Merchandise Value (GMV) increasing by 28%, while in the UAE, orders climbed by 27%, and GMV rose by 16%.

Ramadan itself also showed steady growth. In 2024, overall sales in MENA increased by 7%, with GMV up 5% compared to non-festive months. While Saudi Arabia’s growth remained modest, the UAE saw a 5% jump in order volume and a 7% rise in GMV.

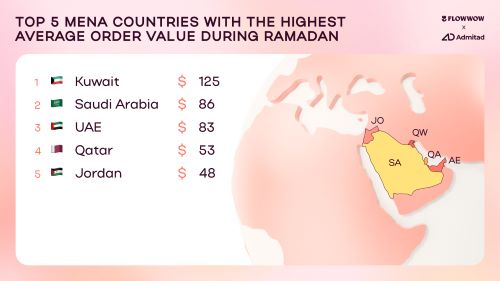

A key trend observed during Ramadan and Eid al-Fitr is the average order value (AOV) increase from $41 to $49 year-over-year, particularly in top-spending countries such as Kuwait, the UAE, and Saudi Arabia. This growth in consumer spending highlights the significance of Ramadan as a peak e-commerce season in the region. Among MENA countries, Kuwait led the way with an average order value of $125, followed by Saudi Arabia at $86, the UAE at $83, Qatar at $53, and Jordan at $48.

How Is Competition Shaping the UAE and MENA Gift Market?

The demand for online shopping during the Ramadan and Eid season is growing, with an increase in mobile orders and over 40% of all purchases in MENA made via mobile devices, and even higher in countries like Saudi Arabia (50%+) and the UAE (up from 39% to 47%). This surge is largely driven by younger generations like Gen-Z, who are fully accustomed to mobile-first, digital commerce.

As a result, the gifting market is intensifying, with more players entering the sector to meet the rising demand. Today’s competitive landscape spans niche gifting marketplaces (Floward, FNP, Flowwow) whereas e-commerce platforms (Amazon UAE), super-apps (Talabat, Deliveroo, Careem), retailers, and offline stores also expand beyond rides and food delivery, quickly launching gifting services to take advantage of the booming demand during Ramadan and Eid.

As the Ramadan season progresses, these marketplaces, particularly regional e-commerce giants, are expanding their gifting categories, introducing new collections, and competing to capture a larger share of the MENA gifting market, which is projected to reach $6.38 billion by 2030. The competition in the e-gifting sector heats up, so niche marketplaces should prioritise convenience, emotional value, and differentiated experience, especially as consumers expect more thoughtful and seamless gifting journeys.

Eid al-Fitr and Ramadan Gifting Trends

Ramadan and Eid al-Fitr are considered peak seasons for gifting platforms, with a notable increase in sales, and the biggest surge happens just days before Eid. According to 2025 data, Ramadan emerged as a key period for the Flowwow gifting marketplace, marking a significant 150%+ surge in gifts demand. The data from Flowwow reveals significant growth in Ramadan 2025 compared to 2024: the Gross Merchandise Value (GMV) increased by 203.7%, while the number of gift sales rose by 152.8%. The average order value for gifts during Ramadan saw a growth of 19.05%, reflecting higher demand and larger purchases in the e-commerce sector during Ramadan and Eid al-Fitr.

“As Ramadan and Eid al-Fitr bring people together, we’re seeing more shoppers choosing meaningful gifts to celebrate and strengthen their connections with loved ones. Flowers, sweets, and gourmet sets remain among the top choices, reflecting the blend of tradition and convenience. Based on current trends, we expect Eid al-Fitr 2025 to set new records, with gifting sales projected to grow by at least 50% compared to last year in the UAE,” commented Slava Bogdan, CEO of Flowwow.

The most popular gift categories for Eid al-Fitr on the marketplaceinclude flowers (73.4%), pastries and confectionery (20.4%), gourmet sets (2%), and edible bouquets (1.5%), which are commonly used to delight family and friends, serve at Iftar dinners, and provide traditional snacks for celebrations.

What MENA Shoppers Are Buying This Ramadan

The most popular e-commerce categories in MENA during Ramadan included fashion, which accounted for 17.8% of total orders. Electronics followed closely at 16%, while home goods represented 15% of all the orders. Automobiles, parts, and accessories made up 8%, and toys and hobbies accounted for 6.5%. Beauty and health products held a 6.2% percent share, while tools comprised 4.7% percent. The mother and kids category represented 4%, and sports and entertainment stood at 3.8%.

Distinct regional trends emerged as well. Saudi Arabia saw increased demand for auto parts and electronics, while home goods, toys, and beauty products were less prioritised. In contrast, UAE shoppers focused more on automotive products, fashion, and accessories, while showing lower demand for beauty items and tools.

Ramadan and Eid al-Fitr continue to drive impressive growth in e-commerce across MENA, with rising sales and increased demand for online gifting. As the gifting market expands, both major platforms and niche marketplaces are tapping into this opportunity. With even stronger sales expected in 2025, Ramadan and Eid will remain key moments for e-commerce, especially in the UAE, Saudi Arabia, and Kuwait. The growing trend of online gifting highlights how meaningful presents bring people closer during this special season.

Last Updated on 3 days by News Desk 1