Oil, Gulf Markets, and Gold Face Downturn – Century Financial

- Crude Oil

Oil prices tumble on growth fears, wiping out 2024 gains: Oil futures settled Tuesday at their lowest prices of the year as downbeat economic data from China and a weak reading on the U.S. manufacturing sector fed worries about a slowdown in energy demand.Oil Futures Sink On Supply-Demand Worries: Crude futures fall to their lowest level in months as the market kicks off September amid concerns about weakening Chinese demand and prospects of OPEC+ raising output next month.Saudi Arabia may cut crude oil prices for Asia in October: Top oil exporter Saudi Arabia is expected to cut prices for most of the crude grades it sells to Asia in October after Middle East benchmark Dubai slumped last month, industry sources said on Monday.

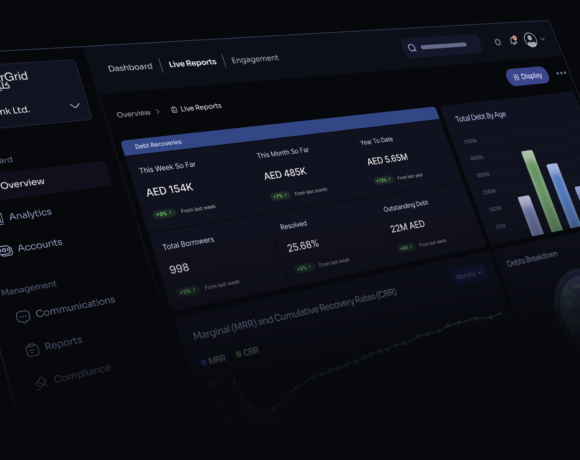

- Gulf Markets

The ADX General is falling 0.3% at 9,350.87 in Abu Dhabi in early trading. Emirates Telecommunications Group Co. PJSC contributed the most to the index decline, decreasing 0.8%. National Marine Dredging Co. had the largest drop, falling 1.9%.

The DFM General Index opened 0.6% lower at 4,342.55 in Dubai. Emirates NBD Bank PJSC contributed the most to the index decline, decreasing 1.2%. Amlak Finance PJSC had the largest drop, falling 2.3%.

The Tadawul All Share Index opened 1.2% lower at 12,034.74 in Riyadh. Saudi Arabian Oil Co. contributed the most to the index decline, decreasing 0.7%. Kingdom Holding Co. had the largest drop, falling 3.1%.

Oil pushed lower after a loss of almost 5% on Tuesday as the possible easing of political unrest in Libya shifted focus back to OPEC+’s plan to boost production, while demand concerns persist.

Brent slipped toward $73 a barrel and West Texas Intermediate fell below $70 for the first time since early January. A Libyan central banker said a deal appeared imminent to resolve a dispute between the rival governments in the strife torn North African nation, which could spur the resumption of oil output

- Gold

Gold extended its decline for the fourth consecutive day to trade near $2,475 on Wednesday. This drop occurred despite a dip in Treasury yields, as risk sentiment soured following weak US manufacturing data. The US ISM Manufacturing PMI rose slightly to 47.2 in August from July’s eight-month low of 46.8 but fell short of the market consensus of 47.5, remaining in contraction territory and raising fears of a hard landing. The commodity’s unexpected decline may be due to overcrowded long positions and margin calls from the broader market sell-off. However, with potential rate cuts on the horizon, losses may be limited. Attention now turns to US JOLTS job openings and ISM Services PMI data due later today, ahead of the crucial Nonfarm Payrolls (NFP) report on Friday, which could provide clues on the future trajectory of interest rate cuts.The immediate support level to watch is $2,470, the low from August 22, followed by the psychological $2,450 mark. A breach of these levels could push prices down towards $2,431, the low from August 15, and the 50-day SMA. On the upside, $2,500 serves as immediate resistance, with the recent all-time high near $2,531 as the next level to watch.Gold prices in the UAE for the day are as follows:

24 Carat AED 302.25

22 Carat AED 279.75

21 Carat AED 270.75

18 Carat AED 232.25

Last Updated on 7 months by News Desk 1