Oil rises but hits lows; gold rebounds on weaker dollar – Saxo Bank MENA

Commodities

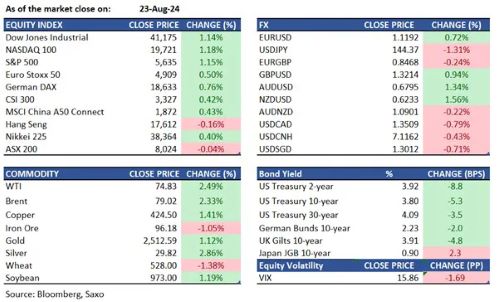

WTI crude oil futures rose 2.49% to $74.83 per barrel, while Brent crude futures increased 2.33% to $79.02 per barrel. Despite these gains, both benchmarks hit their lowest levels since early January due to a significant downward revision in U.S. job growth estimates. Morgan Stanley predicts a surplus in oil supply by 2025 as demand slows and supply increases in Q4. Gold prices rebounded 1.12% to $2,512.59, just below recent record highs, driven by a weaker dollar and lower Treasury yields. The Fed’s indication of a September rate cut also influenced the market. Gold gained 0.4% for the week, with silver up 3.5% and copper up 1.6%.

FX

The US dollar ended the week sharply lower as Fed Chair Powell said that the “time has come” for rate cuts, managing to deliver a dovish message despite the market’s positioning tilting dovish and expecting a larger than 25bps rate cut at the September meeting. The message from Powell also boosted the odds of a soft landing as he was seen unwilling to accept further weakness in the labour market, and this boosted activity currencies such as Kiwi dollar and Australian dollar. The latter will face inflation and retail sales data this week which needs to stay strong to confirm that the RBA can lag the rate cut cycle. The Japanese yen also remains in a strong spot with BOJ’s Ueda keeping rate hikes on the table, in contrast the Powell’s dovish message and escalation in geopolitical risks also providing a haven bid. The euro is at a key level around 1.12 against the US dollar and German Ifo data will be on watch today.

Equities

U.S. stocks rallied on Friday after Fed Chair Jerome Powell indicated that interest rate cuts are imminent, reinforcing expectations of monetary policy easing in September. The S&P 500 climbed 1.1%, the Dow Jones increased by 1.1%, and the Nasdaq advanced 1.4%, driven by strong gains in software and semiconductor stocks. Powell’s comments at the Jackson Hole symposium boosted market confidence, with traders now anticipating a 70% chance of a 25 basis points cut and a 30% chance of a 50 basis points cut. Workday led the Nasdaq with a 12.5% surge, while semiconductor stocks such as Nvidia (4.5%), Marvell Tech (4.6%), Arm Holdings (4.5%), and GlobalFoundries (4%) outperformed. Tesla also rose 4.6%, benefiting from the prospect of lower interest rates, which could make electric vehicles more affordable through cheaper financing. For the week, the S&P 500 and the Nasdaq both gained 1.3%, while the Dow rose by 1%.

Fixed income

Treasuries surged on Friday after Federal Reserve Chair Jerome Powell reinforced expectations for an interest rate cut at the upcoming policy meeting on September 17-18. Speaking at the annual Jackson Hole symposium, Powell stated, “the time has come for policy to adjust.” This front-end-led rally signaled increased bets on a half-point rate cut, with traders now expecting more than 100 basis points of easing by year-end. 2-year Treasury yields had fallen by 9 basis points, widening the 2s10s spread by more than 4 basis points. The 10-year yield closed around 3.805%, down 5 basis points for the day and outperforming the German 10-year yield by 3 basis points. Additionally, the US 5s30s curve widened by more than 4 basis points. Fed-dated Overnight Index Swap (OIS) contracts indicated around 32 basis points of easing for September and 102 basis points by year-end, suggesting at least one half-point rate cut at one of the three remaining meetings. Data from the Commodity Futures Trading Commission showed leveraged accounts increased their net short positions in US 10-year note futures in the week leading up to August 20, extending record bearish positioning in this tenor. Meanwhile, asset managers reduced their bullish positions in the long end of the curve while increasing their net long positions in 10-year note futures over the week.

Macro:

- Fed Chair Powell’s comments at the Jackson Hole conference indicated that a September rate cut is coming as he said that “the time has come for policy to adjust”, and he did not close the door to a 50bps cut either. He avoided words that other Fed committee members used earlier in the week, like “gradual” and “methodical” for the rate cut cycle. Moreover, Powell’s comment that he does not seek or welcome further labour market cooling also emphasized that focus has shifted from inflation to unemployment and the Fed remains open to act bigger if August payrolls data showed deterioration.

- Bank of Japan’s Ueda spoke in the parliament on Friday and indicated that the central bank could hike rates again if inflation and economic data performed as expected. He played down the significance of BOJ’s July rate hike in the market turmoil that ensued after the decision and said that concerns over the health of the US economy was the key catalyst.

Last Updated on 7 months by News Desk 1