PHEV Momentum Pushes Global EV Sales Up 18% In Q1 2024

China Leads With 28% YoY Growth

In the first quarter of 2024, global passenger electric vehicle (EV) sales experienced a robust 18% year-over-year growth, driven prominently by the expanding popularity of plug-in hybrid electric vehicles (PHEVs).

According to the latest findings from Counterpoint’s EV Market Tracker, PHEV sales soared by an impressive 46% compared to the previous year, outpacing the more modest 7% growth in battery electric vehicle (BEV) sales.

China emerged as the clear leader in the global EV market during Q1 2024, showcasing a substantial 28% year-over-year increase in sales.

In contrast, the United States saw a more tempered growth rate of 2% year over year, reflecting a mixed performance across different segments of the EV market. Despite an overall increase in EV sales in the United States, BEV sales declined by 3% yearly.

The resurgence in PHEV adoption comes as leading global EV makers like Tesla and BYD focus on enhancing manufacturing efficiencies to offer more competitive pricing.

Intense Competition

This strategic move has intensified competition within the EV sector, placing pressure on traditional manufacturers such as Ford and GM, which continue to grapple with higher production costs and financial challenges associated with scaling up BEV production.

Counterpoint’s research highlights a strategic shift among automakers towards prioritising PHEVs over BEVs, driven by lower upfront costs and the inclusion of a fuel tank that mitigates range anxiety—a critical concern for potential EV buyers.

This shift underscores a broader industry trend towards achieving cost efficiencies and meeting stringent emission targets to avoid regulatory penalties.

Despite facing a 9% year-over-year decline in BEV sales, Tesla reclaimed its position as the top seller in this segment during Q1 2024, capturing a significant 19% market share.

BYD Group and Volkswagen Group followed closely, with BYD notably achieving a 13% year-over-year growth while both Tesla and Volkswagen experienced declines in their BEV sales.

In the realm of PHEVs, BYD demonstrated exceptional performance, commanding nearly one-third of the global market share in Q1 2024.

Geely Holdings and Li Auto are the key players in this segment, reflecting a diverse competitive landscape driven by evolving consumer preferences and regulatory dynamics.

BYD Tops

BYD’s remarkable export figures underscored its strong global presence, particularly in Southeast Asia, where it recorded a staggering 152% year-over-year growth in EV exports, including PHEVs. This international success highlights the increasing global demand for EVs, driven partly by the versatility and appeal of PHEVs across different markets.

Industry analysts anticipate continued growth in the EV sector throughout 2024, albeit with potential signs of a slowdown compared to previous years.

This shift reflects evolving consumer behaviours and a transition from early adopters to a more mainstream market base, signalling a new phase of maturation and expansion for the EV industry worldwide.

As Tesla navigates production challenges and adjusts to shifting market dynamics, including reduced early-adopter demand in established markets, the broader EV landscape remains poised for further innovation and competitive disruption.

The ongoing evolution of EV technologies and market strategies is set to shape the future of transportation, emphasising sustainability, affordability, and global market integration.

Abu Dhabi EV Hub

Meanwhile, Yas Mall in Abu Dhabi emirate in the United Arab Emirates has become the largest EV charging hub in the Arabian Gulf nation. The mall has 40 EV chargers, including 30 Tesla wall connectors and 12 superchargers, that can add up to 275km of range in just 15 minutes of charging.

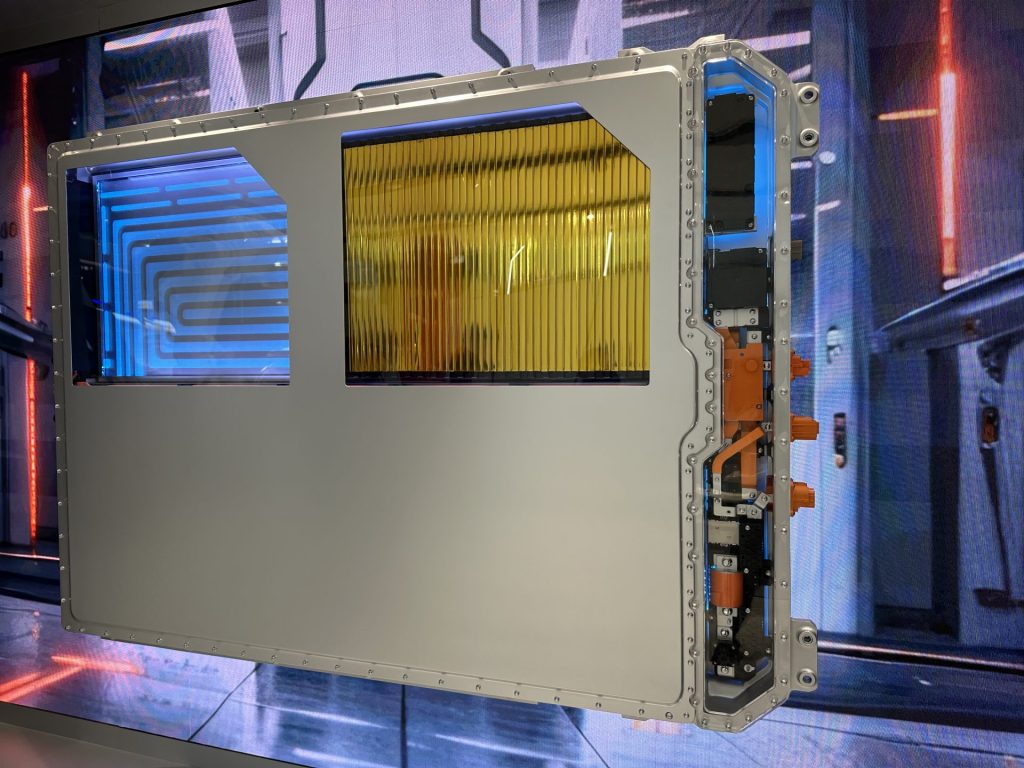

Featured image: Chinese automaker Exeed’s all-new Exlantix ES EV (sedan) on display at a global dealers’ event on April 28, 2024, in Wuhu, China. Credit: Arnold Pinto