Swiss watch exports tick-tock to $31 billion in 2023

Representing a 7.6% increase from 2022

The Swiss watchmaking industry marked a historic milestone in 2023, with exports reaching unprecedented levels in both value and volume. Building on a robust performance from the previous year, the sector has continued its impressive growth trajectory, demonstrating resilience and adaptability amidst a fluctuating global market.

Unprecedented growth

Swiss watch exports soared to a record total value of 26.7 billion Swiss francs*/$31.12 billion in 2023, reflecting a 7.6% increase from the previous year.

This impressive growth was driven by a strong performance throughout the year, although the pace moderated in the latter half. The year’s first half saw a substantial 11.8% increase, which tempered to 3.6% in the second half, aligning with industry expectations.

The surge in export value was accompanied by a notable rise in the volume of watches shipped abroad.

The number of exported watches rose 7.2% to 16.9 million units, marking an additional 1.1 million watches compared to 2022. This robust performance underscores the sector’s recovery and ongoing appeal in luxury and entry-level markets.

Sector dynamics

The growth in Swiss watch exports was driven by increased demand and a broader expansion within the industry.

The Swiss watchmaking sector saw a 7.7% increase in employment, with over 65,000 people now working in the industry. This expansion highlights the sector’s vital role in the Swiss economy and its capacity to absorb new talent as it scales.

With 2024 heading into the last quarter, the industry anticipates a more subdued environment. Export figures and employment levels are expected to remain high but show only modest growth.

Subcontractors and suppliers are bracing for a less favourable outlook, influenced by broader economic uncertainties and a high Swiss franc. This could more acutely impact the entry-level and mid-range segments.

Product segmentation

Regarding product categories, mechanical watches remained a cornerstone of export growth in 2023, accounting for nearly 80% of the increase in export turnover with a 7.0% rise in value. Conversely, quartz watches saw a 12.6% increase in volume, reflecting their strong performance in the market.

The price segment dynamics reveal an evident polarisation: watches priced at 200 Swiss francs saw a significant rise, contributing 83% to the total increase in the number of units exported.

At the high end, watches priced above 3,000 Swiss francs drove 92% of the growth by value. In contrast, the mid-range segment (200-3,000 Swiss francs) exhibited more modest changes, with a slight increase in value and volume.

Steel watches, representing over half of all exports, showed minimal growth in 2023, with a 0.4% increase in volume and a 1.4% rise in value. The main drivers of export turnover were watches made from precious metals (+9.2%) and bimetallic watches (+11.2%).

Regional performance

Swiss watches enjoyed strong performances across various global markets in 2023. The United States, with a 7.0% increase, remained a significant market, absorbing 15.6% of Swiss watch exports.

China saw a 7.6% growth, although it has not fully recovered to pre-crisis levels. Hong Kong’s market rebounded spectacularly with a 23.4% increase, reflecting a recovery from pandemic-related restrictions.

Japan and Singapore posted 7.7% and 2.5% growth, respectively, while the United Arab Emirates experienced a notable 12.2% rise.

European markets displayed consistent growth in 2023, with increases ranging from 5.1% to 9.3% in the United Kingdom, Germany, France, Italy, and Spain. South Korea, however, faced challenges with a 7.3% decline, impacted by competition from duty-free markets in nearby regions.

Outlook for 2024

As the Swiss watchmaking industry traverses 2024, it faces a mixed outlook. While the sector is expected to maintain high export levels and employment figures, caution prevails due to economic uncertainties and the impact of a strong Swiss franc.

The varying performances among different market segments and regions will likely influence the industry’s overall trajectory in the coming year.

Overall, 2023’s exceptional performance underscores Swiss watchmaking’s resilience and global appeal, setting a high benchmark for the industry as it navigates future challenges.

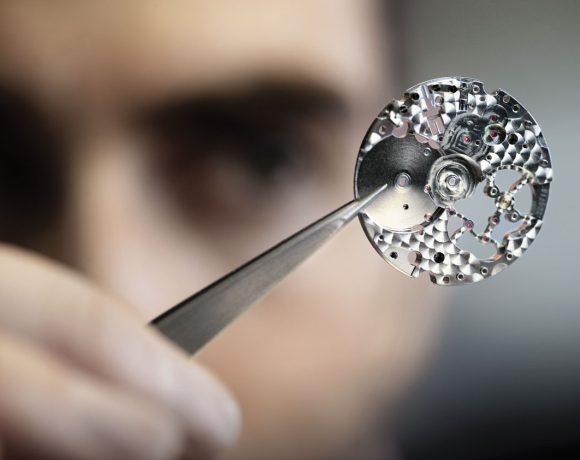

Featured image. The growth in Swiss watch exports in 2023 was driven by increased demand and a broader expansion within the industry. Credit: Meister

(*1 Swiss franc = $1.17).