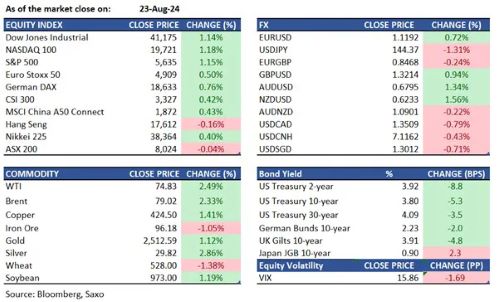

A couple of events were the most important in global financial markets last week; the FOMC Minutes last July and the statements of the Fed Chairman Jerome Powell at the Jackson Hole Symposium. Both were in favor of risk appetite after they tipped the scales towards starting to cut interest

Oil

Oil ends higher as Powell’s Fed policy comments lift prospects for U.S. demand: Oil futures settled higher Friday, extending a bounce from the previous session, after comments from head of the Federal Reserve confirmed prospects for interest-rate cuts that would help strengthen the economy – and demand for crude. Halliburton Hit by Cyberattack:

Commodities WTI crude oil futures rose 2.49% to $74.83 per barrel, while Brent crude futures increased 2.33% to $79.02 per barrel. Despite these gains, both benchmarks hit their lowest levels since early January due to a significant downward revision in U.S. job growth estimates. Morgan Stanley predicts a surplus in oil supply by 2025 as […]

Mark Pussard, Head of Risk, APM Capital Commodities Oil futures posted a loss for the third straight session Tuesday, with prices marking their lowest finish in two weeks dragged down by worries about a slowdown in global energy demand and risk-off sentiment in the U.S. market, coupled with Easing Middle East tensions and hopes for […]

Mark Pussard, Head of Risk, APM Capital Commodities Oil prices eased off a little on Tuesday after five straight winning sessions as supply risks posed by widening Middle Eastern conflict were tempered by demand concerns a day after OPEC cut its forecast for demand growth in 2024. Benchmark Brent crude futures were down $1.32, or […]

Mark Pussard, Head of Risk, APM Capital Commodities Oil prices continued their week-long upward momentum on Friday, snapping a four-week losing streak, with Brent crude futures increasing to $79.66 a barrel. Similarly, US West Texas Intermediate (WTI) crude futures prices rose to $76.18 per barrel. Both contracts gained around 3.70% and 4.50%, respectively, this week. […]

Mark Pussard, Head of Risk, APM Capital Commodities Oil futures rose Wednesday, finding support as data showed a fall in U.S. crude inventories and as stock markets continued their recovery from a global rout that had served to pull down commodity prices. West Texas Intermediate crude for September delivery finished with a gain of $2.03, […]

Mark Pussard, Head of Risk, APM Capital Wallstreet market U.S. stocks closed sharply lower Wednesday in one of the worst trading days of the year. Tesla led the way with a 12.3 % fall. Alphabet lost 5.03 %, while Nvidia closed with a 6.8 % loss. The Standard and Poor’s 500 closed at 5,427.13, falling […]

A larger-than-expected weekly decline in US crude stockpiles and a weaker US currency overcame hints of slower Chinese economic growth as oil prices rose by almost 2% on Wednesday. By 1:33 p.m. EDT (1733 GMT), Brent futures had increased by $1.35, or 1.6%, to $85.08 per barrel, while US West Texas Intermediate (WTI) crude had […]

Oil prices finish lower after Hurricane Beryl leaves energy infrastructure largely unscathed: Oil futures lost ground Tuesday, with U.S. benchmark prices settling at their lowest in nearly two weeks after Hurricane Beryl appeared to leave Texas energy infrastructure with little damage. U.S crude oil futures slipped in post-settlement trading Tuesday even as the American

Shell to Take Impairment Hit of Up to $2 Billion: Shell expects to book up to $2 billion in post-tax impairments after delaying construction of a major biofuels plant as European energy majors grapple with weak market conditions, while trading in its core gas division is set to fall on quarter. Oil prices end higher […]

As May draws to a close and June begins, financial markets worldwide find themselves at a critical juncture. Economic data reveals a mixed picture, with signs of easing inflation tempered by ongoing concerns about growth and the potential for further policy tightening. Central banks grapple with diverging paths, while oil prices remain sensitive to production […]

While the Ukrainian-Russian conflict is starting to slow down, causing less pressure on oil and gas prices, the events following October 7th have stirred things up again in the Middle East, especially with Houthis in Yemen keeping a tight hold on the Red Sea and the escalation of “Operation Prosperity Guardian”. Real concerns about these […]