Totl eyes GCC rollout after stepping up to transform the UAE cashback ecosystem

Innovative startup’s QR tech is a game-changer

In an era where digital transformation is reshaping consumer interactions, Totl, a pioneering fintech firm based in Dubai, United Arab Emirates (UAE), is redefining how businesses connect with customers.

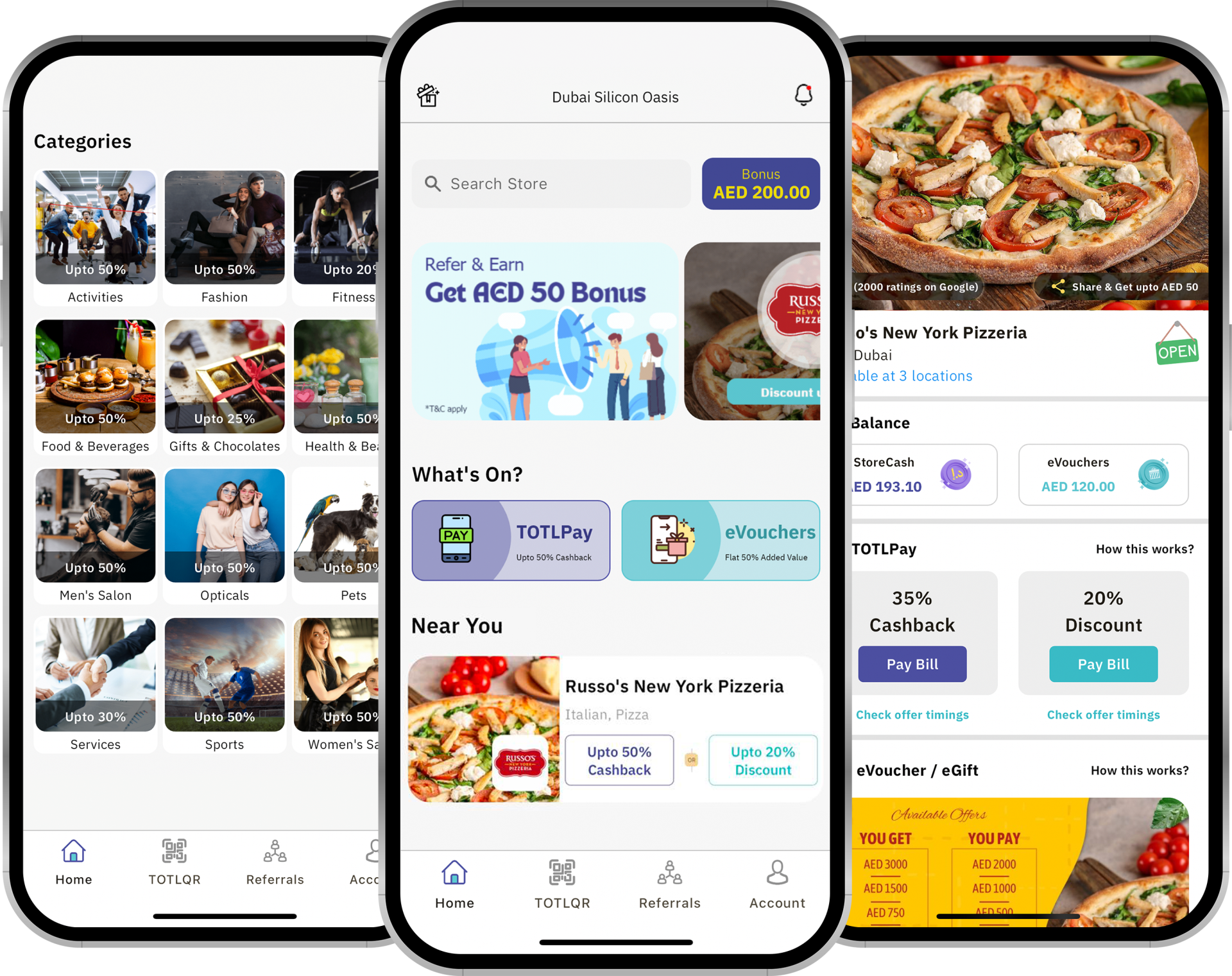

With over 700 businesses across the UAE onboard and $1 million in investments, app-based Totl offers customers a unique blend of services encompassing cashback, bill payments, e-gifts, and takeaway food orders. This distinct value proposition sets Totl apart, making it a compelling choice for businesses seeking to elevate their customer engagement strategies.

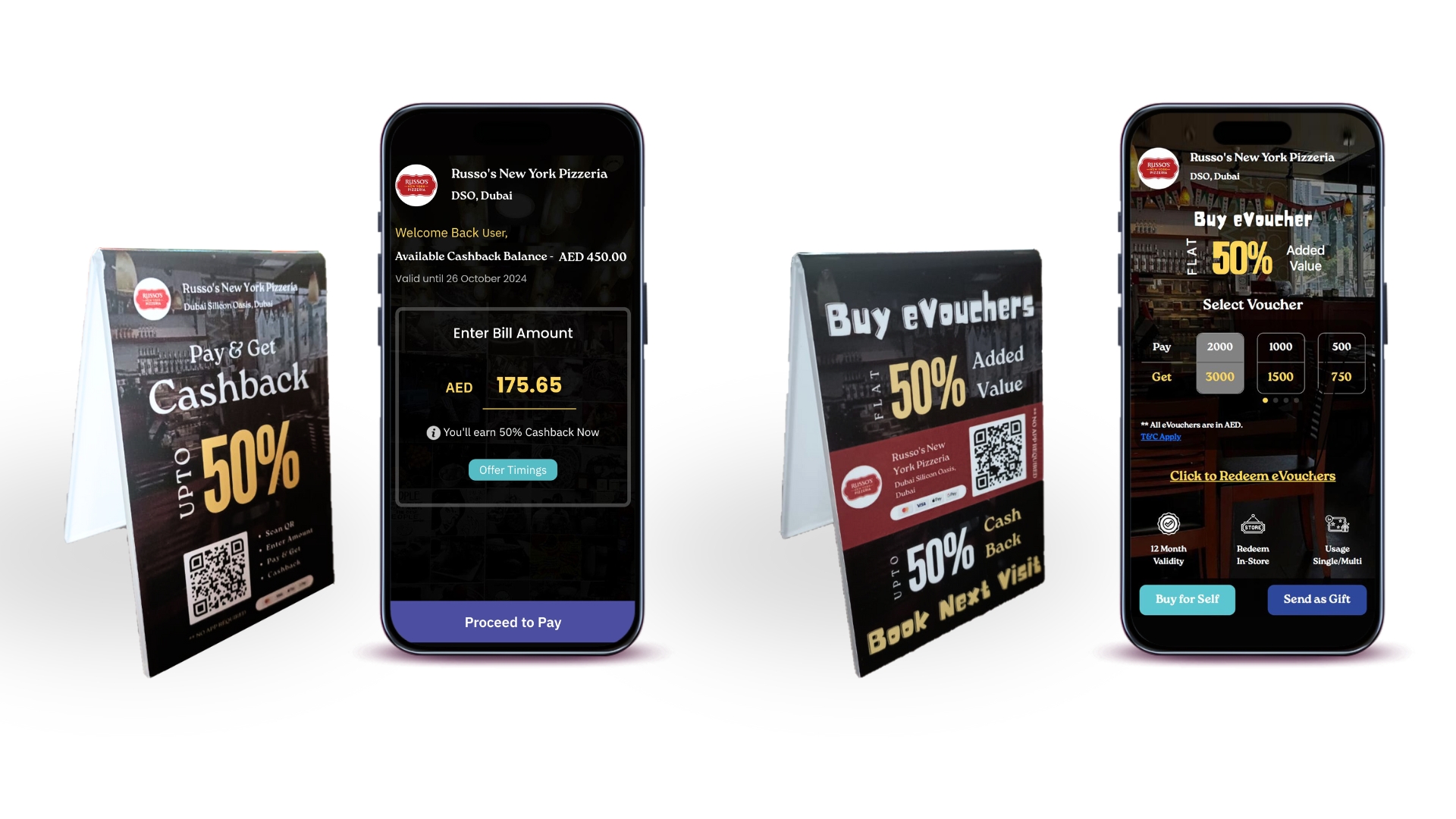

Totl’s innovative approach encourages brand loyalty and enriches customers’ everyday spending experience. Customers can quickly pay via the Totl mobile app or through dynamic QR codes, streamlining transactions and providing immediate value with each purchase.

Dynamic QR tech

Totl’s dynamic QR technology is a game-changer for businesses. This innovative tool allows for customised and repeatable payment experiences, turning routine transactions into engaging interactions.

This innovation concerns transactions and changes how companies and customers interact. It encourages customers to return and creates memorable purchasing experiences. By doing so, Totl is reshaping the UAE’s customer engagement landscape, inspiring businesses to rethink their approach to customer interactions.

At the core of Totl’s offerings is its cutting-edge QR code technology, which bridges consumers and businesses. This technology lets companies directly engage with customers by offering real-time rewards and personalised offers. The result? A remarkable 200% increase in user growth and a 100% rise in new business partnerships over the past year underscored the platform’s effectiveness in fostering engagement and loyalty.

Totl’s mobile app stands out for its user-centric design. It allows for seamless transactions while also delivering valuable insights into customer behaviour. Businesses can leverage this data to build stronger client relationships, enhancing brand loyalty and customer satisfaction. The app also simplifies the payment process, making it accessible and straightforward for users regardless of their tech-savvy levels.

UAE focus

Totl’s continuing commitment to the UAE business community is evident in its efforts to help businesses thrive in a competitive marketplace. The company focuses on building long-term relationships with companies, ensuring they can attract and retain customers through enhanced experiences. This symbiotic relationship benefits the businesses and fosters a sense of community among consumers who feel rewarded for their loyalty.

With payment growth surging by an impressive 500%, Totl is making waves in the fintech sector. Combining instant rewards, cashback offers, and personalised promotions reshapes how consumers interact with brands, ensuring they get more value from everyday spending. As Totl continues to innovate and expand its offerings, it is poised to play a significant role in the future of customer retention and loyalty in the UAE.

Totl is a key exhibitor at Expand North Star, the world’s largest startup and investor connector event at Dubai Harbour, from October 13 to 16, 2024.

Uday Rathod, Co-Founder and CEO of Totl, is a visionary entrepreneur with a diverse family background in manufacturing, commodity trading, investments, and IT services. In 2017, he launched Znapp (now Totl). Like that of Sulochana Betwala, Co-Founder and COO of Totl, his approach emphasises resilience, learning from failures, and building trust through referrals.

In an exclusive interview with Middle East News 247 at Expand North Star on October 13, 2024, Uday Rathod highlighted the company’s innovative approach to cashback solutions, overcoming fintech challenges with strategic thinking and preparation for growth in the GCC region while continuing to reshape customer engagement and loyalty in the UAE market.

Excerpts from the interview:

What does the Totl platform offer that differentiates it in the UAE cashback market?

Our platform is focused on providing a unique cashback experience that ties closely with local [UAE-based] businesses. While cashback programmes are familiar—especially with credit cards—we have developed a model where users [customers] earn cashback that can only be redeemed at the merchants they initially transacted with.

This creates a cycle where customers keep returning to the same businesses, enhancing their lifetime value.

What challenges have you encountered in bringing this concept to market?

The primary challenge has been convincing merchants that this is not just another discount platform. Our cashback model drives repeat business, translating to higher average transaction values.

Our data shows that customers often spend more when they know they can earn cashback. Initially, educating merchants took some time, but as we have matured, communicating our value proposition has become more accessible.

Your operations currently focus on the UAE. Are there plans for expansion?

Looking ahead, Totl is not content with just the UAE. The company is laying a solid foundation in the UAE for about a year or two before venturing into the broader Gulf Cooperation Council (GCC) market. With significant potential in sight, Totl is preparing for a fundraising round to support its growth.

What advantages do you see in operating in the UAE?

The UAE government’s support for ease of business is crucial. It streamlines processes, making it easier for startups like ours to thrive and grow. Additionally, merchants in the UAE tend to be tech-savvy. They know the latest advancements, including AI, which allows for more fruitful conversations about integrating technology into their businesses.

Speaking of growth, can you share your transaction figures in AED?

Indeed, our growth has been impressive. In our first year, we processed about 20,000 transactions. The following year, this number jumped to 200,000; we reached approximately 1.4 million last year. This year, we are on track to surpass that, potentially hitting between 3.5 million and 4 million. Just last quarter, we saw a staggering 300% increase in transactions.

That is impressive growth. Are you considering entering the Saudi market?

Saudi Arabia is definitely on our radar, but we want to ensure our base in the UAE is robust first. We have spent three years refining our product and understanding the UAE market. We must thoroughly understand the dynamics before expanding into Saudi Arabia.

Data security is paramount in fintech. Where do you store customer data?

We take data security very seriously. Recently, we migrated all our data to AWS’s regional infrastructure in Dubai. This ensures customer data is securely stored locally, and we adhere to the highest data protection standards.

How does participating in industry events like Expand North Star benefit your company?

Industry events like Expand North Star are invaluable. They provide a platform to connect with investors and showcase our work. Since we participated in Expand North Star this year, we have already received several requests for meetings with interested investors, which is a significant step for us.

What technologies underpin the Totl platform?

Our backend is primarily built on Python, which is robust for handling data and transactions. For our mobile app, we chose Flutter. It allows us to develop for both Android and iOS from a single codebase, streamlining our development process. We also utilise Stripe and local [UAE-based] payment networks to provide flexible payment options.

Given the UAE market’s rapid evolution, how do you foresee the future of cashback platforms?

The UAE market is saturated with discount platforms, but cashback is still relatively untapped. Discounts may provide a short-term boost, but cashback fosters customer loyalty and repeat business. We aim to integrate cashback with loyalty programmes, creating an ecosystem supporting companies and consumers.

Can you share the backstory of how you and your co-founders started Totl?

Our journey was rocky at first. Initially, we developed a cashback model based on uploading receipts for FMCG purchases. However, the Covid pandemic disrupted everything. Many partners dropped out, and we faced tough decisions.

In the chaos, we pivoted towards helping restaurants recover lost business by incentivising consumers to return. Our goal was to leave a lasting impact in the GCC region and create a pioneering product for our market.

You have a clear vision and a firm plan for the future.

Thank you! I appreciate the opportunity to share our story.

Featured image: Uday Rathod, Co-Founder & CEO of Totl, wants to take his innovative startup to new horizons in the GCC region. Credit: Arnold Pinto

Last Updated on 3 months by Arnold Pinto