Global EV sales poised for 10-million milestone in 2024

Hybrids to surpass EVs and ICE vehicles

In a significant shift for the global automotive industry, electric vehicle (EV) sales are projected to hit the 10-million mark in 2024. This highlights a decisive turn away from Internal Combustion Engine (ICE) vehicles.

The milestone comes amid projections that ICE vehicles’ market share will dip below 50% within the next four years. Sales figures referenced here denote wholesale deliveries from respective automakers.

The resurgence of EV sales follows a temporary slowdown in 2024 as traditional automakers in Europe and the United States grapple with profitability challenges.

Recognising the inevitable rise of EVs, major players in the automotive industry, such as Ford, GM, Stellantis, and Volkswagen, are strategically reengineering their production processes.

They are also forming strategic partnerships with battery manufacturers in China, intending to reduce manufacturing costs, make EVs more affordable, and strengthen supply chains.

EU-China tariff standoff

The anticipated surge in EV sales globally in 2024 coincides with the European Union’s (EU) plan to impose tariffs on EVs manufactured in China.

These tariffs—provisional for four months—range from 17.4% to 37.6% and take effect on July 5, 2024. They will significantly escalate tensions in the EU’s most significant trade dispute with China to date.

The Chinese government has hinted at possible broad retaliatory measures in response, underscoring the complex and interconnected nature of the global automotive market. Both sides are likely to lose out in an all-out tit-for-tat tariff war.

EU President Ursula von der Leyen has defended the imposition of EU tariffs to protect the European automaking industry from cheap EVs produced in China, which the Chinese state subsidises.

EU trade chief Valdis Dombrovskis stated the EU’s objective is to ensure fair competition and a level playing field. An EU anti-subsidy investigation is ongoing and expected to conclude in approximately four months. Following this, the European Commission may propose definitive duties, typically lasting five years, subject to approval by EU members.

Dombrovskis highlighted ongoing discussions with Beijing, noting the potential for mutually beneficial resolutions that could lead to the avoidance of tariffs, provided such solutions address current market distortions and adhere to market regulations.

EV in 30 seconds

As with every industrial manufacturing sector, Chinese players produce much faster and at cheaper rates than those made elsewhere. For instance, at its state-of-the-art super smart factory in Chongqing City, China, EV maker Seres can manufacture a complete EV in 30 seconds – an exclusive world record.

With over 1,000 intelligent devices and more than 3,000 robots working collaboratively, the Seres facility achieves 100% automation in critical processes.

Commenting on the shift of EV sales in 2024, Abhik Mukherjee, a research analyst at Counterpoint Technology Market Research, stated: “Automakers are strategically overhauling their supply chains to prepare for the production of affordable EVs priced below $35,000.

“This transformation aims to meet stringent emission regulations and capitalises on evolving subsidies and burgeoning consumer demand, revitalising the global BEV market starting from late 2025.”

China continues to wield substantial influence in the EV sector and is projected to achieve EV sales four times greater than North America by 2024.

Dominating with more than 50% of the global EV market share until 2027, China is anticipated to maintain its leadership position even as Europe and North America emerge as significant growth markets from 2025 onward.

BYD to topple Tesla

Highlighting the competitive landscape, BYD is set to surpass Tesla in EV sales in 2024, underscoring the dynamic nature of the global EV market.

According to the latest Kantar BrandZ Most Valuable Global Brands 2024 report, BYD has also maintained its place in the Top 10 global automotive brands for the second year, boasting a brand value exceeding $10 billion. Kantar BrandZ is the world’s most extensive consumer-centric brand valuation system.

In 2023, BYD’s car sales exceeded 3.02 million units, marking a remarkable 334% year-on-year export growth. Cumulatively, BYD has sold over 7.6 million EVs to date.

The shifting balance in market leadership reflects evolving consumer preferences and manufacturing capabilities across the industry.

Liz Lee, Associate Director at Counterpoint Technology Market Research, commented on the EU’s tariff policies: “The EU’s adjustment of tariff rates for Chinese EVs aims to level the playing field for European manufacturers, who face stiff competition from lower-cost Chinese imports.

Emerging markets beckon

“These tariffs may redirect Chinese automakers toward emerging markets across the Middle East, Africa, Latin America, Southeast Asia, Australia, and New Zealand.”

As automakers transition to fully electric vehicles, hybrid variants such as Plug-in Hybrid Electric Vehicles (PHEVs) and Hybrid Electric Vehicles (HEVs) are expected to dominate the electrified vehicle segment in the short term.

Automakers are leveraging these hybrid technologies to meet stringent fleet emission standards while paving the way for cost-effective BEV manufacturing and robust control over the supply chain.

The broader industry push towards electric mobility necessitates substantial investments in charging infrastructure and grid modernisation. These developments are crucial for supporting the widespread adoption of electric vehicles and aligning with global climate goals.

As the automotive landscape shifts towards electrification, the impending milestone of 10 million EV sales in 2024 signifies a pivotal moment. With ICE vehicles facing a decline and hybrid technologies playing a crucial role in the interim, the industry is poised for transformative growth and innovation in the years ahead.

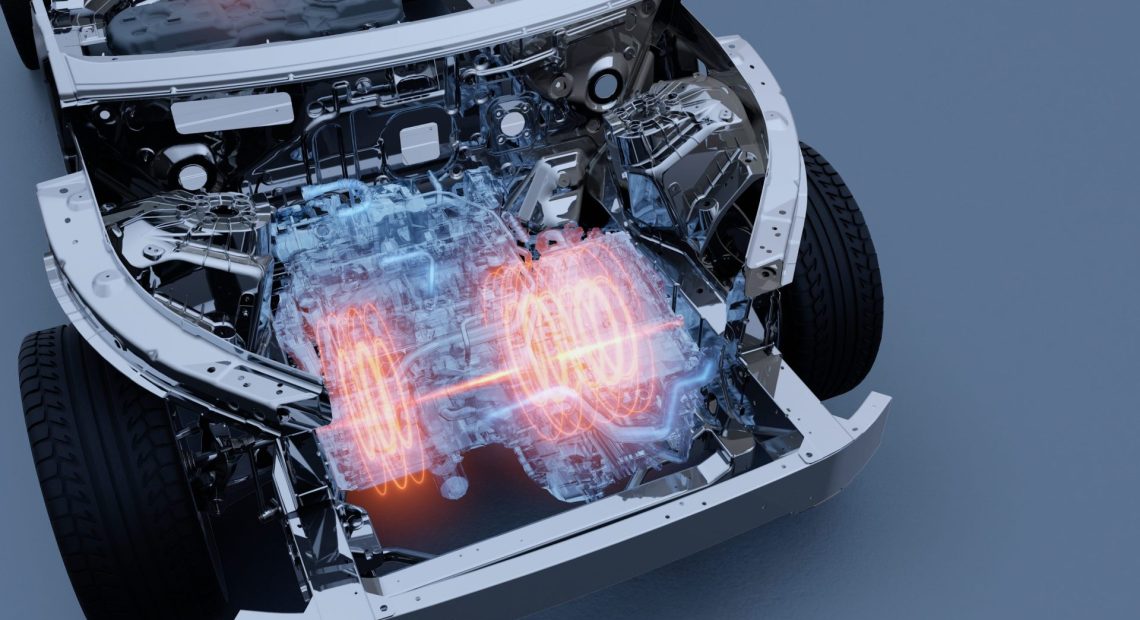

Featured image: CGI of the EV powertrain of a Seres EV. Global automakers are forming strategic partnerships with battery manufacturers in China to reduce manufacturing costs and make EVs more affordable. Credit: Seres