COT Report: Managed money’s year-end positioning in forex and commodities – Saxo Bank MENA

Forex:

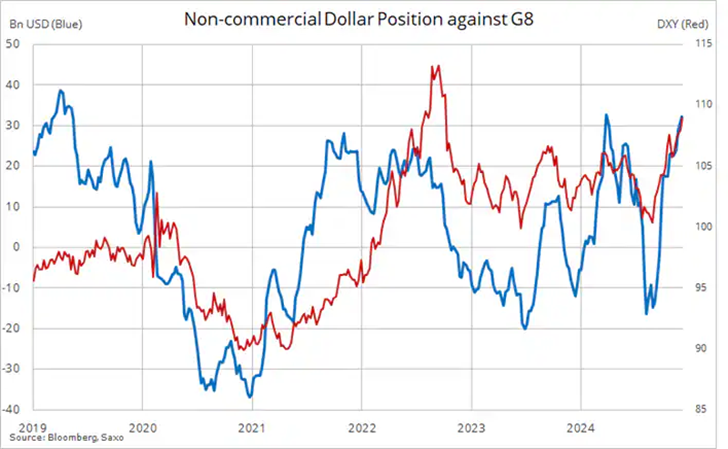

In forex, speculators ended the year holding a USD 32.3 billion net long USD position versus eight IMM futures contracts and the DXY. Apart from a brief peak last April, this was the biggest bet on a stronger dollar since mid-2019. This helps explain the sudden burst of dollar selling on Monday following a report from the Washington Post that, according to sources, Trump may not seek broad-based tariffs, preferring to target key imports instead. Trump specifically denied the rumors, though this only partially defused the USD weakness as flows became less one-sided in favor of the dollar, as seen during the past couple of months. Besides small net longs in GBP and MXN, all other currencies were traded from the short side, led by CAD (-$12.3bn equivalent), EUR (-$9bn), CHF (-$4.6bn), and AUD (-$4.4bn).

The net non-commercial dollar position versus eight IMM futures in week to 31 December

Non-commercial IMM futures positions versus the dollar in the week to 31 December

Commodities:

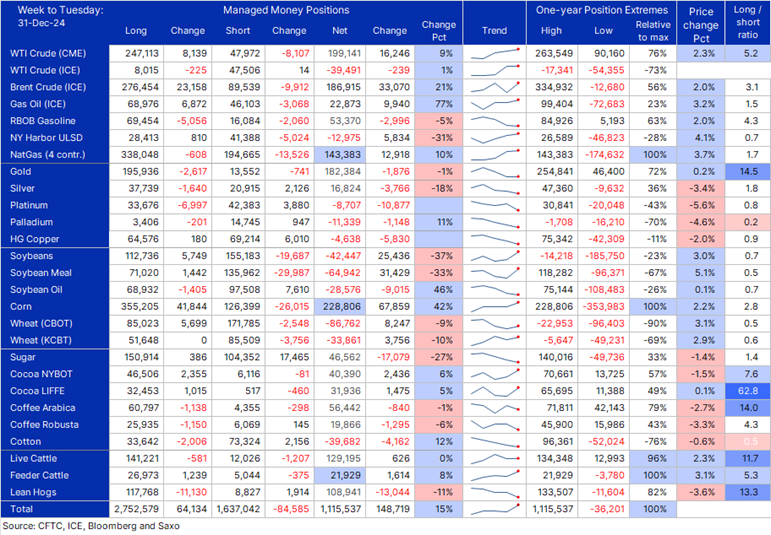

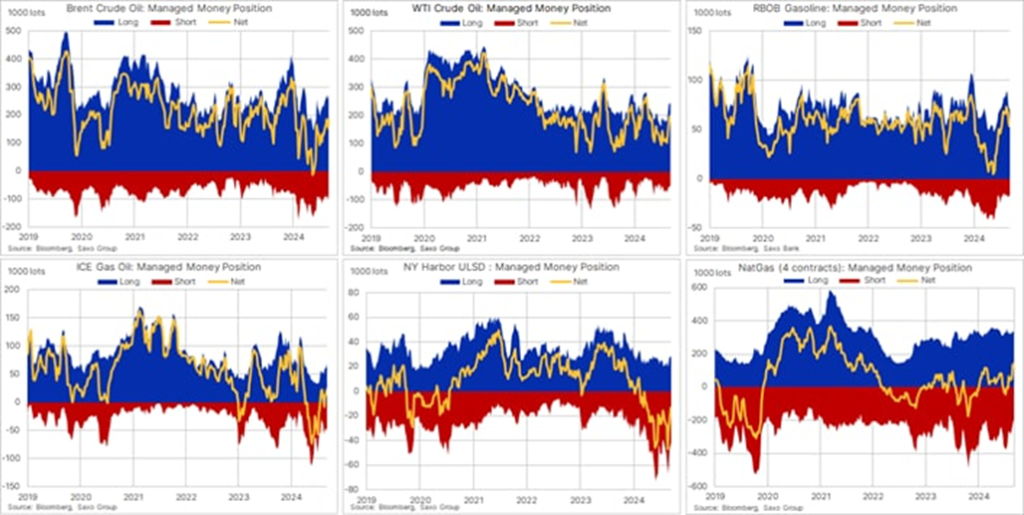

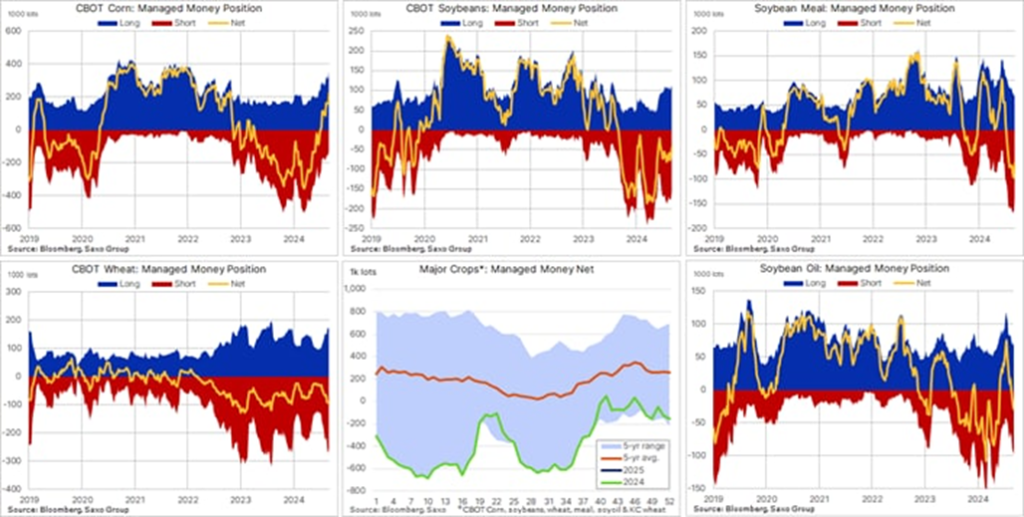

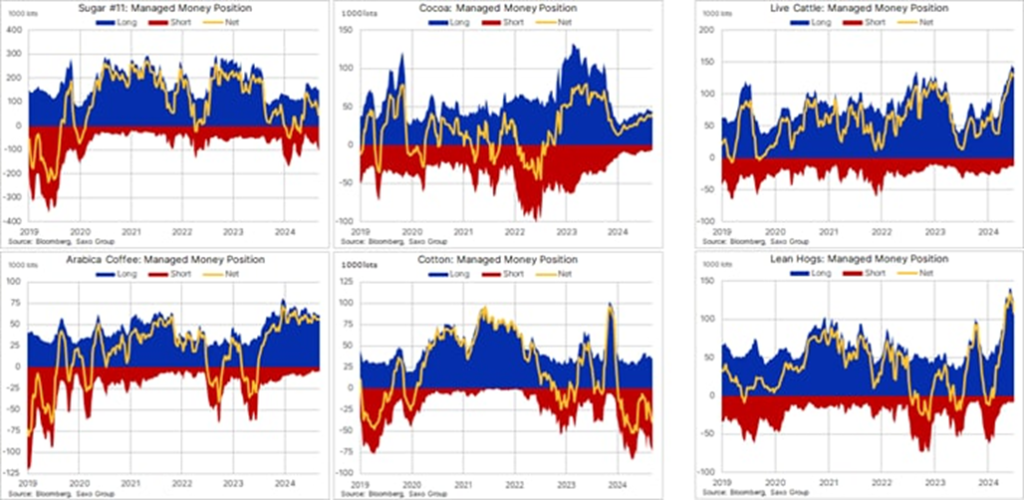

Speculators exhibited a relatively buoyant mood ahead of year-end according to data covering managed money activity in the week to 31 December. While activity ground to a halt, the Bloomberg Commodity Index nevertheless managed to rise 0.6% despite continued headwinds from a stronger dollar, which rose by the same amount. Demand, however, was focused primarily on the energy sector, which rose 2.2%, and the grains, which gained 2.7%. At the other end of the scale, the metal sector, both investment and industrial metals, saw net selling, weighed down by end-of-year profit-taking courtesy of the stronger dollar and early 2025 demand concerns sending copper lower to challenge key support. On an individual level, the buying was concentrated in WTI and Brent crude oil, the two distillate (diesel) contracts, natural gas, and the three major grains contracts, while sellers focused on platinum, copper, sugar, and hogs.

Managed money commodities long, short, and net positions, as well as changes in the week to 31 December

Energy: Crude oil buying lifted the combined net long in WTI and Brent to a five-month high at 347k contracts, driven by a combination of fresh longs and reduced shorts. Elsewhere, the two diesel contracts also saw demand, while surging natural gas prices drove a 10% increase to near a three-year high.

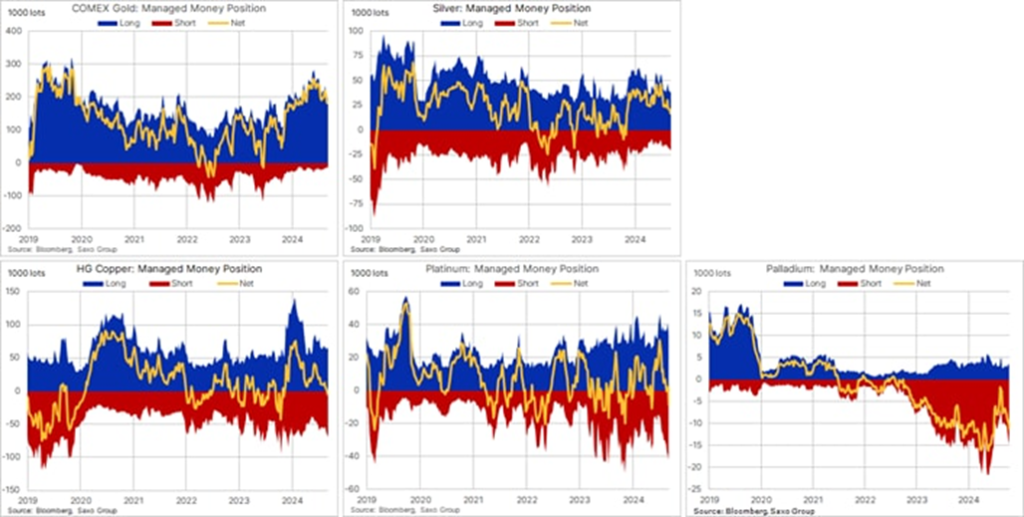

Metals: Gold saw light profit-taking ahead of year-end, while silver net selling picked up. Both the platinum and copper positions flipped back to net short, in copper for the first time since March, partly explaining the early January bounce from key support in the USD 4 area.

Grains: Speculators rushed into corn as it reached a six-month high, resulting in a 42% jump in the net long to a 22-month high at 229k contracts, while short-covering supported soybeans and wheat.

Softs and livestock: Softs were mixed with profit-taking seen in sugar and coffee, while the cotton net short continued to rise. In livestock, the cattle net long remained elevated.

What is the Commitments of Traders report?

The COT reports are issued by the U.S. Commodity Futures Trading Commission (CFTC) and the ICE Exchange Europe for Brent crude oil and gas oil. They are released every Friday after the U.S. close with data from the week ending the previous Tuesday. They break down the open interest in futures markets into different groups of users depending on the asset class.

Commodities: Producer/Merchant/Processor/User, Swap dealers, Managed Money and other

Financials: Dealer/Intermediary; Asset Manager/Institutional; Leveraged Funds and other

Forex: A broad breakdown between commercial and non-commercial (speculators)

The main reasons why we focus primarily on the behavior of speculators, such as hedge funds and trend-following CTA’s are:

- They are likely to have tight stops and no underlying exposure that is being hedged

- This makes them most reactive to changes in fundamental or technical price developments

- It provides views about major trends but also helps to decipher when a reversal is looming

Do note that this group tends to anticipate, accelerate, and amplify price changes that have been set in motion by fundamentals. Being followers of momentum, this strategy often sees this group of traders buy into strength and sell into weakness, meaning that they are often found holding the biggest long near the peak of a cycle or the biggest short position ahead of a through in the market.

Last Updated on 1 month by News Desk 1