Funds boost metals investment as dollar long positions halve amid weakness – Saxo Bank MENA

Commodities

The reporting week saw global financial markets continue a strong rebound, with early August’s market turmoil now a distant memory. Instead, increased expectations for a September US rate cut helped drive stock markets sharply higher and the dollar and long-end US Treasury yields lower. Elsewhere, China, the world’s top consumer of commodities, showed small signs of improvement, and the combination of lower funding costs and demand recovering saw industrial metals put in a strong performance, with the BCOM Industrial Metal Total Return Index rising 4.5% on the week. Precious metals enjoyed the incoming tailwind from lower funding costs, while the energy sector remained troubled by signs of weakening demand, not least for diesel.

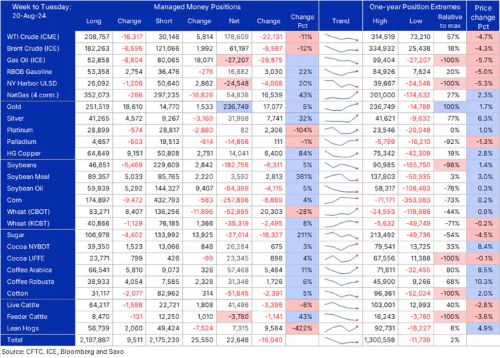

Overall, these mixed signals for commodities saw buying of industrial and precious metals offset by selling of energy, softs, and to a lesser extent grains. On an individual level, hedge funds increased their gold long to a four-year high, the copper net long jumped 84% from near neutral, while the wheat net short was reduced by 28%, and the natural gas long jumped 43%. Selling was concentrated in crude oil and gas oil (diesel), as well as soybeans, corn, and sugar.

Energy: Crude oil selling resumed, and led by WTI, it reduced the combined net long to 240k, while the gas oil short jumped to a 15-month high at 27k contracts. Buyers returned to natural gas, but overall, the net long at 55k remains relatively small.

Metals: Gold’s almost uninterrupted rally to a fresh record high saw the net long increase by 8% to a fresh four-year high at 237k contracts, the silver long jumped by one-third to 32k, while buyers returned to HG copper (+84% to 6.4k) after the price started to recover.

Grains: The sector saw mixed action, overall leaving a still very elevated net short in soybeans, corn and wheat near unchanged at 494k contracts, with selling of soybeans and corn being offset by short-covering in wheat.

The softs sector saw a 200% increase in the sugar short and a cotton short rising back to near a record high disguise demand for cocoa and coffee, both of which only saw small increases in their net longs despite much higher prices amid continued adverse weather support.

Forex

In the week to 20 August, the dollar fell around 1%, with broad losses driving a 56% reduction in the dollar gross long vs 8 IMM futures to USD 4.9 billion, a five-month low. The reduction was primarily driven by a doubling of the euro long to 56k contracts (USD 4 billion equivalent), continued GBP buying, and not least CAD, where speculators recently held a record short position amid the outlook for a faster rate cut trajectory in Canada compared with the US. A negative view that was challenged in the past couple of weeks—forcing short positions to be closed—as the chance of a September US rate cut rose. Elsewhere, the first JPY net long since March 2021 held steady last week.

Last Updated on 8 months by PR News Desk