Gold Near Record Highs Amid Geopolitical Tensions; Markets Soar as S&P 500 and Nasdaq Hit Records – Saxo Bank

Macro:

- FOMC minutes show that policymakers stressed caution in monetary policy due to high uncertainty. They considered maintaining restrictive rates if the economy remained strong and inflation high but noted easing could occur if the labor market weakened, economic activity slowed, or inflation quickly returned to 2%. They emphasized the need for more evidence of sustained disinflation.

- US housing starts fell 9.8% month-over-month to an annualized 1.366 million in January 2025, down from December’s 10-month high of 1.515 million and below the 1.4 million forecast. Severe snowstorms and cold weather disrupted construction, with potential rebounds limited by rising import tariffs and high mortgage rates.

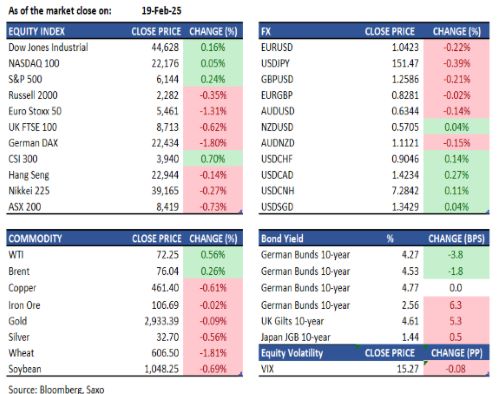

· Gold hovered near record highs at $2,935 an ounce due to geopolitical tensions, despite the Fed’s rate stance. Concerns grew as Trump suggested pulling US support for Ukraine after Russia’s 2022 invasion, urging Zelenskiy to swiftly negotiate with Russia.

· Oil prices rose due to supply uncertainties from Russia, Kazakhstan, and OPEC+. WTI surpassed $72 a barrel, its highest close in a week, driven by transatlantic supply concerns and a key technical level supporting prices.

Equities

- US – On Wednesday, the S&P 500 and Nasdaq 100 reached record highs, increasing by 0.2% and 0.1%, while the Dow Jones gained 73 points. Investors considered the latest Federal Reserve minutes and President Trump’s new tariff threats. Trump announced a 25% tariff on auto, semiconductor, and pharmaceutical imports from April 2, increasing trade uncertainty. The Fed minutes showed officials remain cautious, wanting more inflation progress before rate cuts, and noting potential trade policy risks. Gains were led by healthcare and consumer staples stocks, with Eli Lilly and UnitedHealth both up over 1%, and Walmart rising ahead of its earnings report. In contrast, Palantir’s stock fell 10% as CEO Alex Karp plans to sell over $1 billion in shares, and the Pentagon considers an 8% defence budget cut in each of the next five years.

- EU – European stocks dropped sharply due to poor earnings and trade barrier concerns. The Eurozone’s STOXX 600 fell 1.4% to 5,458, with financials and consumer discretionary stocks leading losses. Auto producers like Stellantis and Volkswagen declined after Trump hinted at tariffs. Philips fell 11% on missed sales expectations. European leaders met in Paris to discuss defence spending amid US signals of reduced defence integration.

- HK – HSI dropped 0.14% to 22,944 due to tech stock profit-taking and concerns over Trump’s 25% tariff plans. Despite Beijing’s pro-tech stance, doubts about the Chinese stock rally persisted. Minimal declines in China’s home prices helped limit losses.

FX

- USD retreated from its highs to trade around 107.1 after the FOMC Minutes suggested maintaining current rates, with some participants considering pausing the balance sheet runoff due to debt ceiling concerns.

- EUR weakened and traded around $1.045 amid Ukraine concerns and comments from US President Trump about President Zelensky, though hawkish remarks from ECB’s Schnabel limited the downside.

- GBP gradually declined, falling below the 1.26 level as the dollar strengthened slightly, despite UK CPI data being stronger than expected.

- NZD rebounded after the RBNZ’s third 50bps rate cut, with potential for further cuts if inflation decreases. Governor Orr is optimistic about inflation and expects the cash rate to be around 3% by year-end.

- JPY strengthened near 151 against USD due to geopolitical concerns and recent remarks from BoJ board member Takata.

- MXN weakened past 20.4 against USD, nearing a three-year low, as risk aversion grew following U.S. President Trump’s renewed tariff threats on imports, escalating U.S.-Mexico trade concerns.

- Major economic data: China loan prime rate, UK CBI industrial trends orders, Canada New Housing Price, US initial jobless claims, EU consumer confidence flash

Last Updated on 1 month by News Desk 1