Saxo Bank announces $111 million net profit in 2023

Bank registers $136 billion in client assets

Saxo Bank Group, a leading financial institution, has revealed its 2023 financial performance, reporting an adjusted net profit of $111 million, down from $121 million in 2022.

Despite challenges like a $53 million software write-down and a $16 million impact from the Saxo Geely Tech Holding divestment, the bank reached a milestone with over 1.1 million clients and $136 billion in client assets.

The software write-down was linked to the BinckBank migration, underscoring the importance of a unified global technology stack. Simultaneously, the divestment optimised business operations, aligning focus with core markets and clients.

The financial landscape of 2023 saw lower trading due to rising inflation and market stability.

However, higher interest rates positively influenced Saxo Bank’s performance. Despite the challenging conditions, the bank’s $111 million profit is acceptable and aligns with guidance.

The bank’s commitment to clients was evident through market-leading interest rates and commissions. Net funding of $12 billion in cash and securities contributed to reaching a record level of 1.1 million clients and $136 billion in client assets.

Key financial highlights (2023 vs 2022)

- Total income: $642 million ($637 million)

- Net profit: $30 million ($82 million)

- Adjusted net profit: $111 million ($82 million)

- Total equity: $1.1 billion ($1.2 billion)

- Total client assets: $136 billion ($107 billion)

- Total end clients: 1,159,000 (1,018,000)

- Capital ratio: 32% (31%)

Kim Fournais, CEO of Saxo Bank, acknowledged 2023 as a year of progress, reaching a record client base and assets.

Introducing an innovative interest rate model was pivotal, enabling clients to earn competitive market rates on uninvested cash without typical restrictions.

Fournais stressed Saxo Bank’s commitment as a systemically important financial institution (SIFI) and its responsibility to be a trustworthy partner.

The strategic focus remains unwavering, emphasising client and asset growth, product enhancement, and a pledge to operate prudently and compliantly.

The announcement concluded with details about Saxo Bank’s Annual General Meeting, which will be held electronically on March 21, 2024. The meeting aims to discuss the bank’s achievements, challenges, and future strategies.

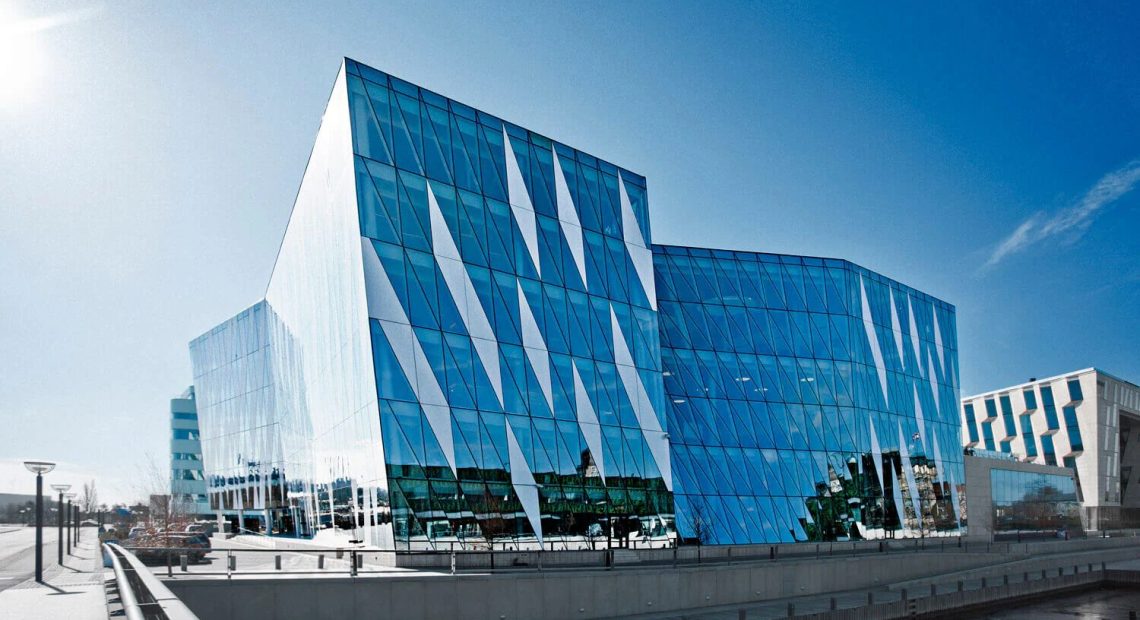

With its headquarters in Copenhagen, Saxo employs more than 2,500 professionals in financial centres worldwide, including London, Singapore, Amsterdam, Hong Kong, Zurich, Dubai and Tokyo.Top of Form

Featured image: Saxo headquarters in Copenhagen, Denmark: Credit: Saxo