Spanish ceramic tile sector banks on Middle East demand

The region stands out as a beacon of opportunity and growth

Since the start of 2024, the Spanish ceramic tile industry has been increasingly focussing on the Middle East market as other legacy global markets shrink due to the Ukraine-Russia conflict, Red Sea shipping attacks, and growing competition from a handful of Asian nations.

Over the past eight years, the Middle East region – encompassing the hydrocarbon-rich United Arab Emirates and Saudi Arabia – has emerged as a key player in driving the growth of Spain’s ceramic tile exports, with industry leaders citing the region’s rising demand for high-quality tiles and sustained economic development as primary factors.

The Middle East ceramic tiles market is poised to grow by $3.15 billion from 2023-2030, accelerating at a CAGR of 6.8% during the forecast period.

Pivotal market

According to recent statistics from the Spanish Ceramic Tile Manufacturer’s Association (ASCER), the GCC region, particularly the broader Middle East region, has become a pivotal market for Spanish ceramic tiles, accounting for a significant share of the industry’s total exports.

In 2023 alone, Spain exported over 200 million square metres of ceramic tiles to the Middle East, representing a staggering 15% increase compared to 2022.

The allure of the Middle East lies not only in its increasing demand for ceramic tiles but also in the region’s commitment to urban development and infrastructure projects.

The construction boom in the GCC nations led by the United Arab Emirates, Saudi Arabia, and Qatar has created a robust market for construction materials, with Spanish tiles gaining prominence for their quality, design, and durability.

During a recent press conference, the CEO of a leading Spanish ceramic tile manufacturer highlighted the strategic importance of the Middle East market.

“The Middle East is not just a market; it’s a gateway to a broader global landscape. The demand for our ceramic tiles in the region is a testament to the quality and innovation Spanish manufacturers bring to the table,” he stated.

The statistics echo this sentiment, revealing that the Middle East now constitutes 20% of Spain’s ceramic tile exports.

Fuelling the demand

This surge can be attributed to a combination of factors, including the region’s growing population, increased disposable income, and a cultural affinity for sophisticated and aesthetically pleasing interiors.

The Middle East’s architectural and design preferences align well with Spanish ceramic tiles’ diverse and intricate offerings.

Spanish manufacturers have invested significantly in research and development to create tiles that meet the region’s climate’s technical specifications and cater to Middle Eastern consumers’ discerning tastes.

One of the key drivers of this success is the adaptability of Spanish ceramic tiles to various applications, from residential spaces to commercial and hospitality projects.

The Spanish tiles are renowned for blending traditional artisanry with modern design, offering a wide range of options for architects and designers in the Middle East.

Sustainable practices

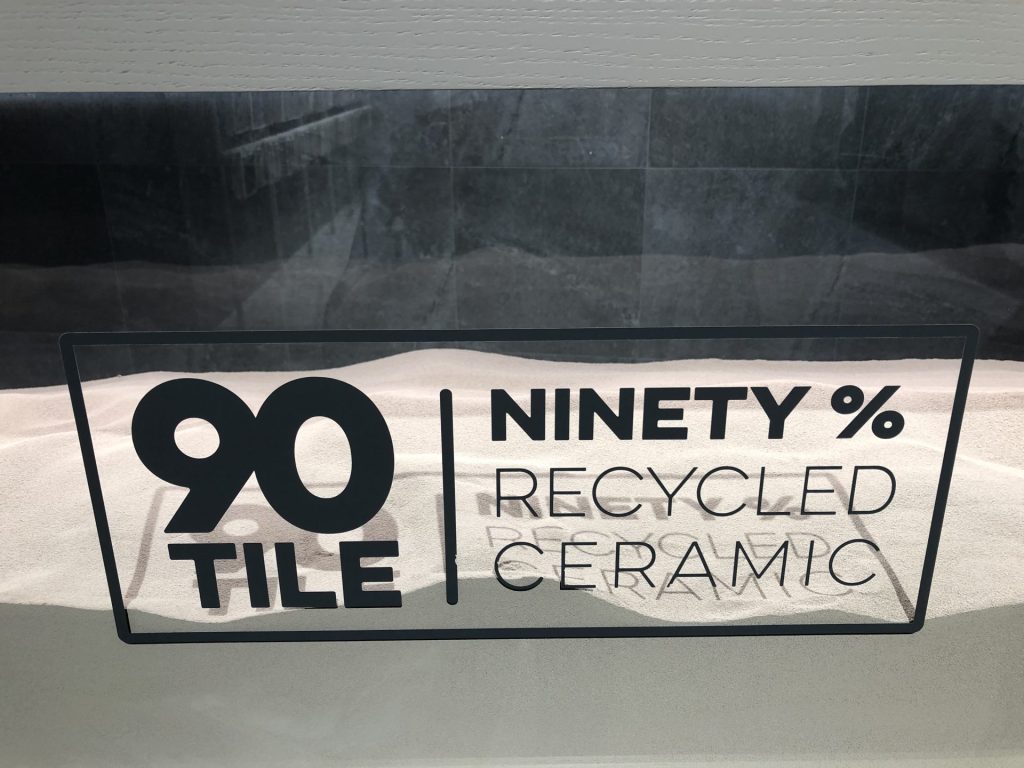

In addition to its aesthetic appeal, the Spanish ceramic tile industry has embraced sustainable practices, aligning with the Middle East’s increasing focus on eco-friendly construction materials.

In particular, the Spanish ceramic tile industry has witnessed a notable uptick in demand for tiles with environmentally friendly certifications, further solidifying its position in the Middle Eastern market.

While the Middle East has become a vital market for the Spanish ceramic tile industry, experts believe there is still untapped potential.

The region’s commitment to continuous urbanisation and a burgeoning tourism industry offers opportunities for further growth.

Industry analysts project that Spanish ceramic tile exports to the Middle East could see a double-digit percentage increase in the coming years thanks to the tiles’ exceptional design, sustainability, and consumer appeal.

The synergy between Spanish innovation and Middle Eastern demand has created a symbiotic relationship, fostering economic development in both regions. The strategic focus on the Middle East is a short-term strategy for the Spanish ceramic tile industry and a calculated move towards long-term global expansion.

Tile of Spain

Tile of Spain, the overarching brand representing the Spanish tile industry, plays a pivotal role in elevating the presence of Spanish tiles domestically and internationally.

With a primary objective to accentuate the advantages of Spanish tiles, the brand encourages their adoption by materials specifiers and distributors.

Key economic driver

The Spanish tile industry is a pivotal driver of economic growth in the Valencia region and Spain.

According to a PwC report titled ‘The Socioeconomic and Fiscal Impact of the Wall and Floor Tile Sector in Spain,’ the sector contributes 19.7% to the Gross Domestic Product (GDP) of the Valencia region. Additionally, it constitutes more than 23% of the total GDP of Castellón province.

For every euro directly contributed to the GDP by the tile sector, an additional 2.9 euros are indirectly generated. This highlights the sector’s role as a catalyst for broader economic activity.

Regarding employment, the Spanish tile industry accounts for 14.3% of industrial jobs in the Valencia region and 21.2% of overall employment in Castellón province, where 94% of Spain’s ceramic tiles are produced.

The significance of the sector’s workforce extends to job creation, with each direct job in the industry resulting in an additional 3.9 indirect jobs across the Spanish economy.

CEVISAMA 2024

The majority of the Spanish ceramic tile manufacturers are exhibiting their latest offerings at the 40th edition of CEVISAMA – the leading international tradeshow for ceramics, bathroom equipment, natural stone, and related sectors – taking place from February 26 to March 1, 2024, in Valencia.

Organised by Feria Valencia and with the support of ASCER, CEVISAMA 2024 is showcasing innovation, technology, trends, and sustainability, encompassing new materials, machinery and industrialised construction.

Featured image: The Spanish tile sector depends on export markets for survival. Image: Arnold Pinto