During 2024, the Saxo Bank Group rolled out a new competitive pricing structure that lowers costs for clients as well as improvements to the client experience, leading to a record number of clients and client assets, with over 1.2 million end clients and USD 122 billion in client assets as of

Saxo Bank

The Fed and politics: does the Powell Fed want to avoid Trump?Fed Chair Jay Powell made it clear on Friday that the Fed is ready to begin cutting rates. In his speech at an annual Fed gathering in Jackson Hole, Wyoming, Powell stated that “The time has come for policy to adjust. The direction of […]

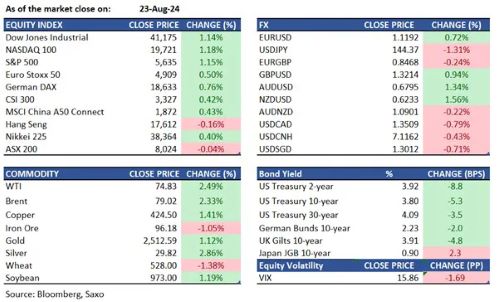

Commodities WTI crude oil futures rose 2.49% to $74.83 per barrel, while Brent crude futures increased 2.33% to $79.02 per barrel. Despite these gains, both benchmarks hit their lowest levels since early January due to a significant downward revision in U.S. job growth estimates. Morgan Stanley predicts a surplus in oil supply by 2025 as […]

Commodities: Global financial markets have made a strong recovery, with early August’s market turmoil now a distant memory. This turnaround comes after better-than-expected US economic data reduced fears of a severe downturn in the world’s largest economy, thereby easing pressure on the Federal Open Market Committee (FOMC) to implement deep interest rate cuts.

Markets remain tense following the labour market shock in early August, which highlighted concerns about the rising unemployment rate and fuelled recession fears in the US. The debate between a soft landing and a looming recession has been a central theme in market discussions, and we discussed this macro theme in detail in our blog […]

Since reaching a record high at USD 5.2 per pound in late May, the High-Grade copper contract has slumped 20%, with the bulk of the decline seen during the past month when the demand outlook in China continued to deteriorate, and US data increasingly began pointing to a slowdown. The premature surge to record highs […]

In the last Thursday and Friday trading sessions and pre-market today, markets have experienced a significant spike in volatility, sparking widespread concern among investors. The VIX, commonly known as the “fear gauge,” has surged to levels not seen in recent times, reflecting a heightened state of market anxiety. This dramatic rise in volatility indicators,

The energy sector is heading for its biggest monthly loss since May 2023, with headlines this past month being dominated by the poor outlook for Chinese demand as economic weakness persists in the world’s top importer of crude oil. In addition, the recent loss of risk appetite across key stock market sectors has also led […]

Middle East also factored in Saxo Bank has released its latest outlook for Q3 2024, which paints a cautious picture of the global economy amidst what the Danish bank terms a ‘sandcastle economy’. Despite robust growth in sectors such as defence, AI, and pharmaceuticals, Saxo’s strategy team highlights significant vulnerabilities that could threaten the stability […]

Commodities: Oil increased as tensions escalated in the Middle East following the death of an Egyptian soldier in a clash with Israeli troops. WTI rose by approximately 1% from Friday’s close to near $79 a barrel, while Brent traded close to $83. Egypt’s military confirmed the death at the Rafah crossing into Gaza, potentially heightening […]

Saxo Bank Client Survey Reveals Saxo Bank has unveiled the results of its latest client survey, shedding light on investor sentiments and expectations concerning the financial markets for the second quarter of 2024. Despite the unpredictability of the global financial market, investors’ responses echo concerns over prevailing market uncertainty. The Client Sentiment

Bank registers $136 billion in client assets Saxo Bank Group, a leading financial institution, has revealed its 2023 financial performance, reporting an adjusted net profit of $111 million, down from $121 million in 2022. Despite challenges like a $53 million software write-down and a $16 million impact from the Saxo Geely Tech Holding divestment, the […]

Summary: US PCE inflation data for December continued to support the notion of a disinflation trend. Despite reaching an intra-day record high at 4,907, the S&P 500 pulled back, closing the Friday session at 4,891, down 0.1%, primarily due to weakness in the information technology sector. The Nasdaq 100 declined by 0.6%, with Intel having […]