WGC report: Gold rises by 12% year-to-date

Central banks play a key role

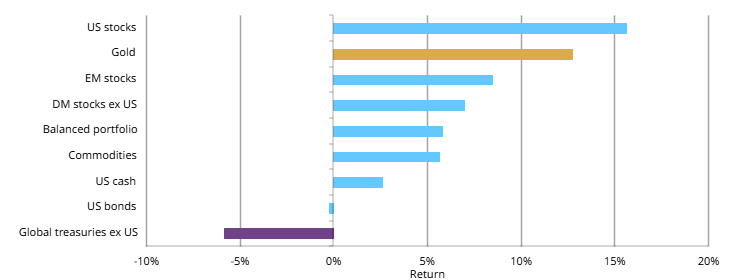

In the tumultuous landscape of global finance, gold has performed remarkably well in 2024, rising by 12% year-to-date and outperforming other major asset classes.

According to the newly released Gold Mid-Year Outlook 2024 report issued by the London, UK-headquartered World Gold Council (WGC), the precious metal has surged, defying conventional wisdom and outstripping the performance of many other major asset classes.

According to the WGC, a complex interplay of factors has underpinned gold’s remarkable ascent. Chief among these has been sustained buying from central banks, particularly in Asia, where investment flows have remained robust. Concurrently, global consumer demand has proven resilient, buoyed by ongoing geopolitical instability that has cultivated a cautious optimism among investors seeking safe havens.

Looking ahead, market observers’ question is whether gold can maintain its momentum or if the current rally is poised to falter.

Analysts suggest that the current price levels reflect consensus expectations for the remainder of the year. However, the dynamics of global markets rarely adhere strictly to projections, leaving investors and analysts alike eagerly anticipating the catalyst that could propel gold to new heights or trigger a corrective phase.

The recent performance of gold contrasts sharply with prevailing economic conditions characterised by wavering growth and persistent inflation pressures.

The metal has flourished despite a global environment marked by sporadic interest rate adjustments and a strong US dollar—typically considered detrimental to gold’s appeal.

Resilient nature

This resilience underscores the intricate nature of gold’s relationship with actual interest rates and currency valuations, which, while significant, have been counterbalanced by other prevailing market forces.

An analysis of leading market experts using sophisticated models indicates that the current gold price aligns closely with anticipated market developments for the latter half of the year.

This suggests that, barring unforeseen disruptions, gold may continue to trade within its recent range, consolidating gains made earlier in the year.

The prospect of Western investors entering the market represents a potential game-changer, says the WGC. Despite their relative absence thus far, indications of increasing interest, particularly following recent monetary policy shifts by major central banks, could inject fresh momentum into gold’s trajectory.

Such developments would complement ongoing support from Asian investors and bolster gold’s standing as a diversified asset amidst an increasingly complacent equity market.

Nevertheless, risks loom large on the horizon. A downturn in central bank purchases or a reversal in Asian investor sentiment could undermine gold’s upward trajectory. The role of consumers, particularly in key markets like India and China, also remains pivotal, as their buying patterns respond sensitively to price volatility and economic stability.

While the road ahead for gold remains uncertain, its role as a strategic asset in global portfolios appears secure. Whether as a hedge against economic uncertainty, a refuge amid geopolitical turmoil, or a diversification tool in asset allocation strategies, gold exerts a powerful allure in an increasingly complex financial landscape.

As market participants await the next catalyst that could redefine gold’s trajectory, one thing remains clear: in 2024, the golden age of uncertainty promises both challenges and opportunities for investors worldwide.

Featured image: Gold may continue to trade within its recent range, consolidating gains made earlier in the year. Credit: Anne Nygard